Porter's Five Forces Explained (+Template)

Porter's Five Forces seem complex? This guide and template simplify the process, helping you assess your industry’s potential with ease.

When assessing any industry, the key questions to ask are:

How competitive is it?

Who holds the power?

What are the main threats and pressures?

That’s where Porter’s Five Forces analysis comes in.

Porter’s Five Forces is a strategic framework for assessing the competitive pressures in your industry. It helps you evaluate industry attractiveness and uncover potential risks.

It’s a classic framework, and for good reason.

If your company has been in the industry for a while (meaning you're an incumbent), this framework can help you map out the competitive landscape and adjust your strategy.

If you're exploring a new industry, it’s a great way to assess whether it’s even worth entering. High barriers and intense competition might make you think twice. Lower pressure could signal opportunity (but likely not just for you).

While some argue that Porter’s framework is rigid or outdated, I believe it remains highly relevant when used thoughtfully. But it does require time, research, and it often lacks a clear structure.

To make the process easier and more actionable, I’ve put together a Google Sheets template. Start by capturing your current assumptions, then refine them as you gather insights and validate them with real data and research. This template will guide you, making the analysis both clearer and more impactful as you uncover the competitive dynamics in your industry.

Let’s dive in.

Grab your Porter's Five Forces analysis template here:

What are Porter’s Five Forces?

Michael Porter, aka the founder of the modern strategy field, identified five key forces that shape industry competition.

In 1979.

But they are still relevant today.

Each of those forces affects the overall profitability and attractiveness of any industry for both current players and potential entrants.

Let's go through them one by one.

Force 1: Threat of New Entrants

The easier it is for new players to enter, the harder it can be to maintain margins or grow market share in the long term.

Thus, the main question to answer here is:

Can new companies easily enter and compete?

Yes → High Threat → Bad for incumbents, good for new entrants (at first).

New players can enter with low costs or few barriers, increasing competition and lowering margins. But over time, the market may become overcrowded and less profitable for everyone.

No → Low Threat → Good for incumbents, bad for new entrants.

High entry barriers protect existing companies from new threats.

For example, micro SaaS has little to no barriers to entry. If you're competing in that space, the threat of new entrants is high.

On the other hand, industries like automotive or airlines, which are equipment-heavy, have high barriers to entry and thus have a low threat of new entrants.

Factors defining barriers to entry, and thus the threat of new entrants (the higher the barrier, the lower the threat), include:

Capital Requirements & Funding Access

High upfront investment makes it difficult for new players to enter without substantial financial backing. Unless such funding is readily available, market entry will be nearly impossible.

Economies of Scale

If established players can produce at lower costs, smaller entrants will find it hard (or even unrealistic) to compete.

Product Differentiation & Customer Loyalty

Strong existing brands with loyal customer bases make it challenging for newcomers to attract customers.

Access to Distribution & Suppliers

Established players often secure the best channels and suppliers, limiting entry opportunities for new players.

Regulation & Legal Barriers

Licenses, compliance requirements, and industry-specific restrictions can delay or even prevent entry.

Technology & Expertise

Proprietary technology or specialized know-how raises the bar for new entrants lacking domain-specific experience.

Switching Costs for Customers

Time, money, or effort required to switch discourages customers from choosing newer players.

Retaliation from Incumbents

If incumbents have a history of aggressive responses (e.g., price cuts, legal pressure), new entrants are likely to face significant challenges entering the market.

Force 2: Bargaining Power of Buyers

High buyer power means they can demand lower prices, better features, or more service.

So, the main question here is:

Do customers have the power to dictate prices or demand more value?

Yes → High Power → Bad for both incumbents and new entrants.

Powerful buyers can pressure you to cut prices or improve offers, shrinking profit margins.

No → Low Power → Good for both incumbents and new entrants.

You have more control over pricing, product features, and positioning.

For example, a niche B2B market could have high bargaining power for buyers, as there are fewer buyers, which means each one can have a significant influence on pricing or terms.

In contrast, any luxury goods space typically has lower bargaining power for buyers, as the high status and exclusivity of the products allow companies to control prices and maintain high margins.

Factors that define the power of buyers may include:

Buyer Concentration

When there are fewer buyers or when buyers control a large portion of the market, they hold more power. They can influence pricing, demand higher value, or pressure sellers into better terms.

Switching Costs

Low switching costs give buyers more power, as they can easily move from one supplier to another without much hassle or financial commitment. High switching costs reduce buyer power, as they are less likely to change suppliers.

Price Sensitivity

When buyers are highly price-sensitive, they can demand lower prices, putting pressure on suppliers to reduce margins. If buyers are less sensitive to price and prioritize product quality or innovation, suppliers hold more power.

Backward Integration Threat

If buyers have the capability or incentive to produce the product themselves (backward integration), suppliers face the risk of buyers bypassing them altogether.

Purchase Volume

Large volume buyers have more leverage, as they represent a significant portion of the supplier’s business. This allows them to negotiate for better prices, discounts, or added services.

Buyer Knowledge

Well-informed buyers who are knowledgeable about market prices, products, and suppliers have more power. Their ability to compare offers and make educated decisions forces suppliers to maintain competitive pricing and value.

Availability of Alternatives

The greater the availability of alternatives, the higher the buyer’s power. Buyers can easily switch to another supplier offering similar products or services, putting pressure on current suppliers to maintain competitiveness.

Influence of Buyer Communities & Reviews

Buyer communities (like online forums or review platforms) and word-of-mouth can amplify buyer power by influencing purchasing decisions.

Force 3: Bargaining Power of Suppliers

Powerful suppliers can raise costs, reduce your flexibility, or both.

The main question:

Do suppliers have significant control over pricing or supply terms?

Yes → High Control → Bad for both incumbents and new entrants.

Fewer or dominant suppliers can raise costs, putting pressure on profit margins.

No → Low Control → Good for both incumbents and new entrants.

More supplier options provide better pricing and negotiation leverage, benefiting both current players and newcomers.

For example, semiconductor suppliers hold power over many industries due to significant concentration in both geographic distribution and corporate control, as well as political factors. This inherently amplifies their power.

On the other hand, food & beverage suppliers have lower power over supermarket chains. Since multiple suppliers offer similar products, supermarkets can switch suppliers without much difficulty or cost.

But take these examples with a grain of salt. I'm writing this in the midst of a tariff war, so supply chains are likely to be disturbed.

Factors that may shape the power of suppliers are:

Supplier Concentration

When there are few suppliers in the market, their bargaining power increases, as their buyers have fewer alternatives.

Supplier Focus

If suppliers focus on a particular industry, they may have less power to dictate terms, as they are highly dependent on that industry.

Switching Costs

High switching costs make it harder for industry players to change suppliers, giving suppliers more leverage.

Pricing Power

Suppliers with the ability to set prices or influence market pricing have significant control.

Forward Integration Threat

If suppliers have the potential or intention to move into their buyers' business (forward integration), they hold more power.

Force 4: Threat of Substitutes

The more compelling the substitutes, the more pressure it puts on your pricing and value proposition.

Thus, the main question:

Are there alternative products or services that could replace yours?

Yes → High Threat → Bad for both incumbents and new entrants.

Customers may switch if substitutes offer better price, convenience, or innovation.

No → Low Threat → Good for both incumbents and new entrants.

Fewer alternatives reduce the risk of customers switching.

For example, if you're a traditional cable TV company, Netflix and other streaming platforms significantly increased the threat of substitutes, as many customers switch to on-demand streaming.

In contrast, in the semiconductor industry, the threat of substitutes is very low. When a specific chip is required, there generally isn’t an alternative that can match its performance or compatibility.

Factors that may shape the threat of substitutes are:

Availability & Quality of Alternatives

When there are alternative products or services that serve the same need, the threat of substitutes increases. The closer the substitutes match the industry offerings in value or performance, the higher the threat.

Switching Behavior & Trends

The easier it is for customers to adopt substitutes, the greater the threat. If industry players are seeing increased pressure from substitute adoption, the threat is higher.

Force 5: Industry Rivalry

High rivalry leads to price wars, shrinking margins, and costly differentiation efforts. And it's heavily influenced by the first four forces.

The main question here is:

How intense is the competition among existing players?

High → Bad for both incumbents and new entrants.

Aggressive pricing, marketing wars, and ongoing innovation costs can erode profits.

Low → Good for both incumbents and new entrants.

A more stable environment often leads to better margins and growth potential.

High rivalry, according to Porter, is tied to the concept of perfect competition. It's common for industries with many sellers offering nearly identical products and minimal barriers to entry or exit. Think agricultural commodities or mass-market retail, where companies compete primarily on price.

It’s rare to find industries with low competitive rivalry, though, unless they operate as a monopoly (e.g., government-regulated utilities) or oligopoly (e.g., the semiconductor industry), where a few dominant players limit competition.

Some of the factors, in addition to the first four forces, that may shape industry rivalry are:

Industry Growth Rate

A slower industry growth rate often leads to more intense competition as companies fight for market share, while faster growth can reduce rivalry by providing more opportunities for all players.

Exit Barriers

When it’s difficult for companies to exit the market (due to sunk costs, long-term contracts, etc.), rivalry intensifies as players are reluctant to leave, leading to prolonged competition.

Strategic Overlap

When companies target the same customers with similar strategies, the competition is more direct, increasing rivalry.

Differentiation

When offerings are highly differentiated, competition tends to be less intense, as companies can carve out unique niches. In contrast, commoditized markets experience greater rivalry, as companies compete primarily on price.

Market Transparency

In markets with high transparency, where competitors' prices and strategies are visible, rivalry increases as companies can quickly respond to each other’s moves.

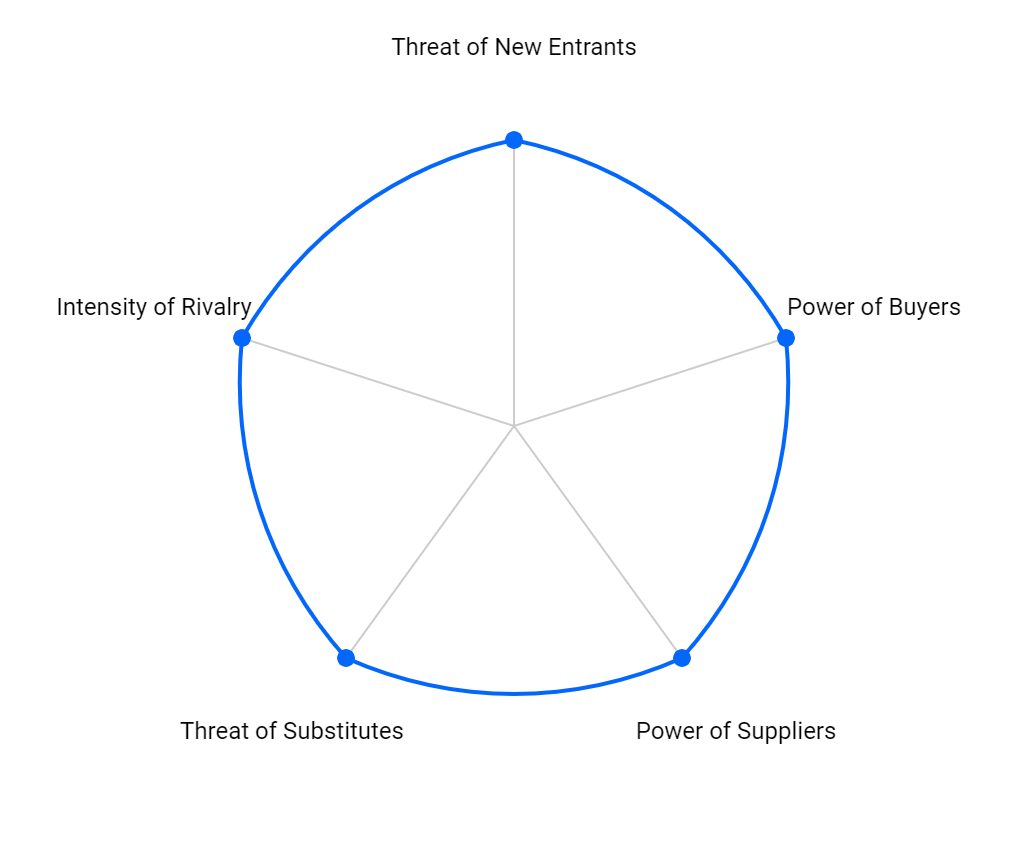

Five Forces Radar Chart

Porter’s Five Forces can be visualized as a radar chart, providing a visual snapshot of the intensity of each competitive force in your industry.

The farther a point is from the center, the stronger the force.

What a Full Radar Chart Tells You

If the chart shows high scores across all five forces, that’s a high-pressure industry.

Here’s what that can typically mean:

New entrants can easily join → More players, lower prices, tighter margins.

Buyers hold power → They can demand lower prices or better terms.

Suppliers hold power → You have limited control over cost and supply quality.

Substitutes are everywhere → Customers can easily switch to alternatives.

Rivalry is intense → Expected price wars, heavy marketing, and high spending on R&D.

Such high pressure means you'll need strong differentiators, a cost advantage, or very niche positioning to succeed.

What a Minimal Radar Chart Tells You

If the radar chart looks like this, with all forces scoring low, that’s a low-pressure industry.

Few new entrants → Barriers like capital, regulation, or strong brand loyalty protect you.

Buyers lack leverage → You set prices, and switching costs work in your favor.

Suppliers are weak → You can negotiate better terms.

Few substitutes → Customers have limited alternatives, keeping demand stable.

Low rivalry → Competitors are fewer or focus on different niches, reducing price wars.

This supports higher margins and stability.

And unless you’re a government-backed monopoly, such a setup likely won’t hold for long.

This is a favorable environment, so it can (and probably will) attract attention. Thus, it’s important to keep an eye on early signals of change, like new technologies or shifting customer behavior. And use your current position to build moats: brand strength, IP, partnerships, or cost advantages.

In reality, your industry’s chart may look anything in between these two extremes.

In the template, once you’re done filling it, the radar chart will be built for you automatically.

Porter’s Five Forces Assessment

There’s no one-size-fits-all approach to assessing Porter’s Five Forces.

But to give you a solid starting point, I’ve created a universal questionnaire, which is included in the template.

For each of the five forces, you'll:

- Answer key questions and rate the intensity of contributing factors

- Assess an overall score for that force (which will be calculated for you automatically)

- Summarize strategic insights

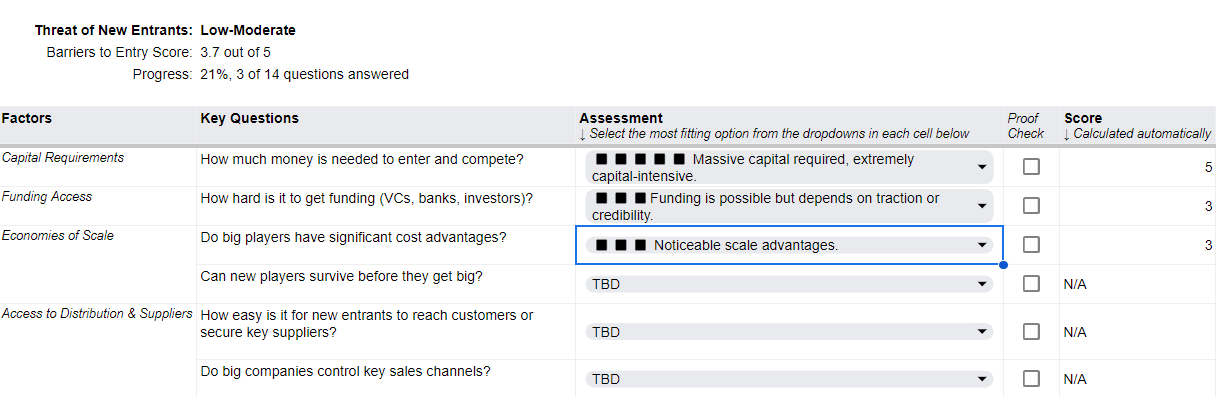

Example: Threat of New Entrants

This force reflects how easy it is for new players to enter your industry.

Easier entry = more competition = thinner margins.

Key factors include Capital Requirements, Funding Access, Economies of Scale, Access to Distribution & Suppliers, Regulation & Legal Barriers, etc.

Each factor includes 1–2 guiding questions, for example:

- Capital Requirements → How much money is needed to enter and compete?

- Funding Access → How hard is it to get funding (VCs, banks, investors)?

- Economies of Scale → Do big players have significant cost advantages?

Scoring Method

Each question assessment uses a 1-5 scale via dropdowns, for example:

How much money is needed to enter and compete?

◼️ Very little capital needed, bootstrappable (thus, low barriers to entry)

◼️◼️ Some upfront costs, but still affordable for small teams or solo founders

◼️◼️◼️ Moderate investment required

◼️◼️◼️◼️ Significant investment needed, high burn rate

◼️◼️◼️◼️◼️ Massive capital required, extremely capital-intensive

The number of squares gives a visual feel for intensity.

No zero score

As you may have noticed, the assessment scale doesn't include a zero score. This is intentional, as I believe that while a force may be mild in any industry, it's highly unlikely for any force to be completely non-existent.

⚠️ Note on Scoring Methodology

The 1-5 scoring system used in this assessment is an ordinal scale, meaning the values represent ranked categories (e.g. “low” to “high”), but the spacing between them isn’t guaranteed to be equal.

Calculating averages across these scores is a heuristic: a practical shortcut to simplify interpretation. It assumes equal intervals between options (e.g., 1→2 equals 4→5), which may not reflect how people actually perceive those jumps.

This average is meant to help spot patterns, not to provide a mathematically precise measurement. If you need higher fidelity, consider using distributions, medians, or calibrated interval scales.

📝 As you complete the questions, the template auto-calculates scores and progress.

To track how grounded your analysis is, I’ve included Proof Check boxes. Use them to flag whether your answer is based on data or intuition.

The same structure applies across all five forces.

Once you're done assessing each force, use the Summary tab to consolidate your scores and capture key strategic takeaways. Good luck!

Tip: Revisit your Five Forces analysis regularly: at least quarterly in fast-changing industries or annually in more stable ones. Additionally, review it after significant market shifts, the emergence of new competitors, or strategic changes to ensure your approach remains relevant.

Disclaimers:

This blog is all about sharing insights and ideas. While I do my best to provide accurate information, I’m not offering legal or financial advice. If you need expert guidance, please reach out to a qualified professional.

I am not affiliated with any of the tools mentioned in this post, and none of the links are referral links. My recommendations are based solely on their relevance, usefulness, and my personal experience using them.