The Ultimate Guide to B2B Market Evolution Analysis

Understand the lifecycle of your market and products to make smarter strategic decisions. This post dives into practical frameworks and real-world examples to help you assess and align your strategies effectively.

So, what do you know about your market?

Is it big? Small? Still in the concept stage?

Is it growing, shrinking, stagnant?

How competitive is it? Is there room for you? Room for others?

These aren’t just passing questions, they’re essential. And knowing the answers is the first step to making informed, strategic decisions. If you’re unsure about any of them, don’t worry. Market Analysis Fundamentals series is designed to help you build a solid market analysis toolkit.

In the first post, we dived into the market structure analysis, breaking down the main players: customers, competitors, and those key partners who help vendors fine-tune, integrate, or distribute their solutions. We also covered the role of regulators, industry analysts, and investors who fuel growth and innovation.

Missed it? Here’s a quick link:

Now, let’s zoom out and look at the bigger picture: how your market evolved over time.

Markets don’t stay static. We all know that. They emerge, grow, mature, and eventually some decline.

But it’s not just the market itself. Each product within it, including yours and those of your competitors, undergoes similar stages of evolution.

In this post, we’ll explore:

- The lifecycle stages B2B tech markets and products typically go through.

- Ways to identify the current stage of your market and products within it.

- Strategies for navigating different market/product stage combinations.

Ready to get strategic? Let’s dive in.

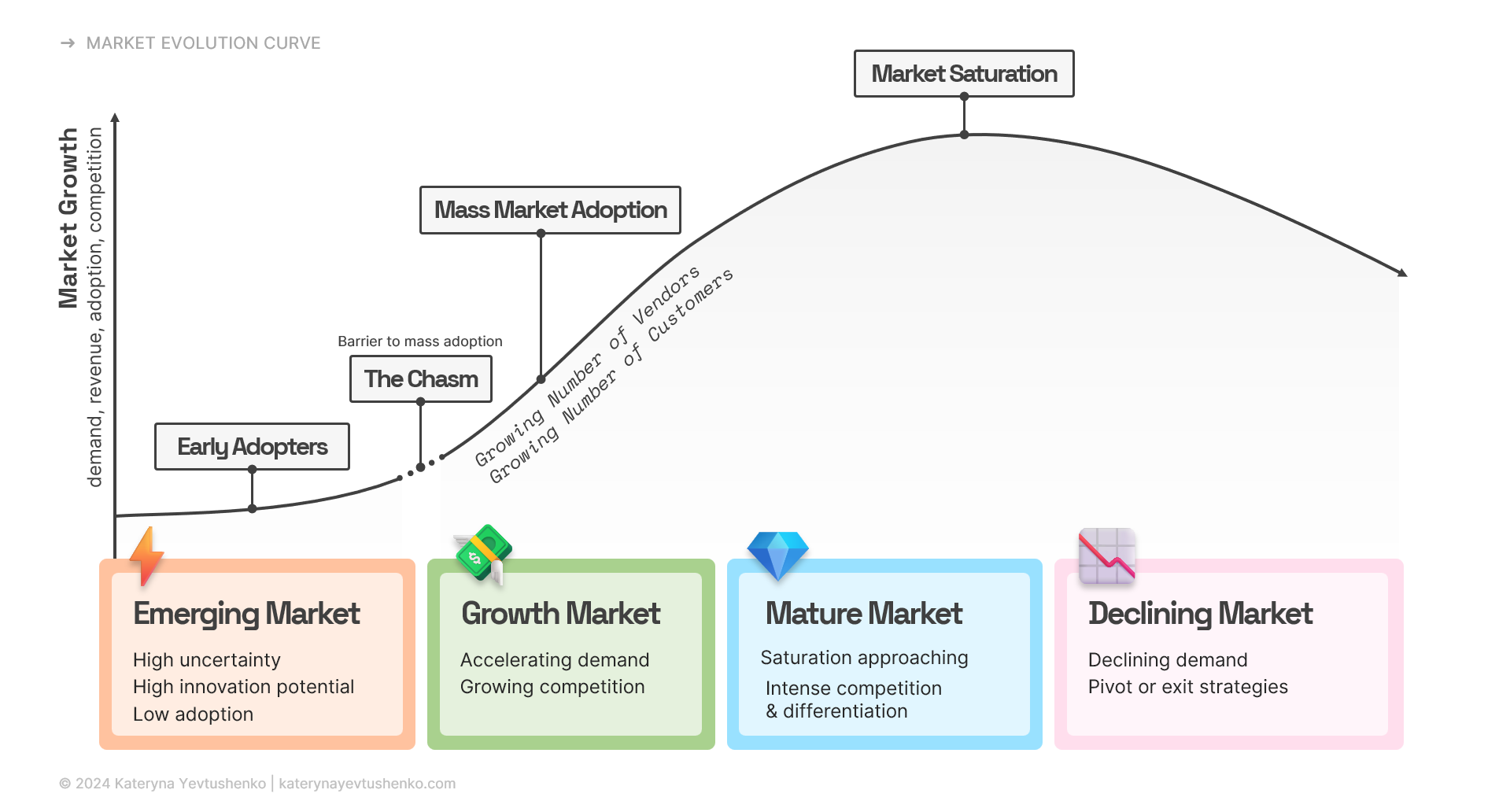

Market Evolution Curve.

Every market starts small: a handful of potential customers, maybe one or two vendors, and lots of questions about whether this thing will even catch on.

Then, as more customers start adopting solutions, the market grows, more vendors pile in, and eventually, we reach a point where everyone seems to be offering something similar.

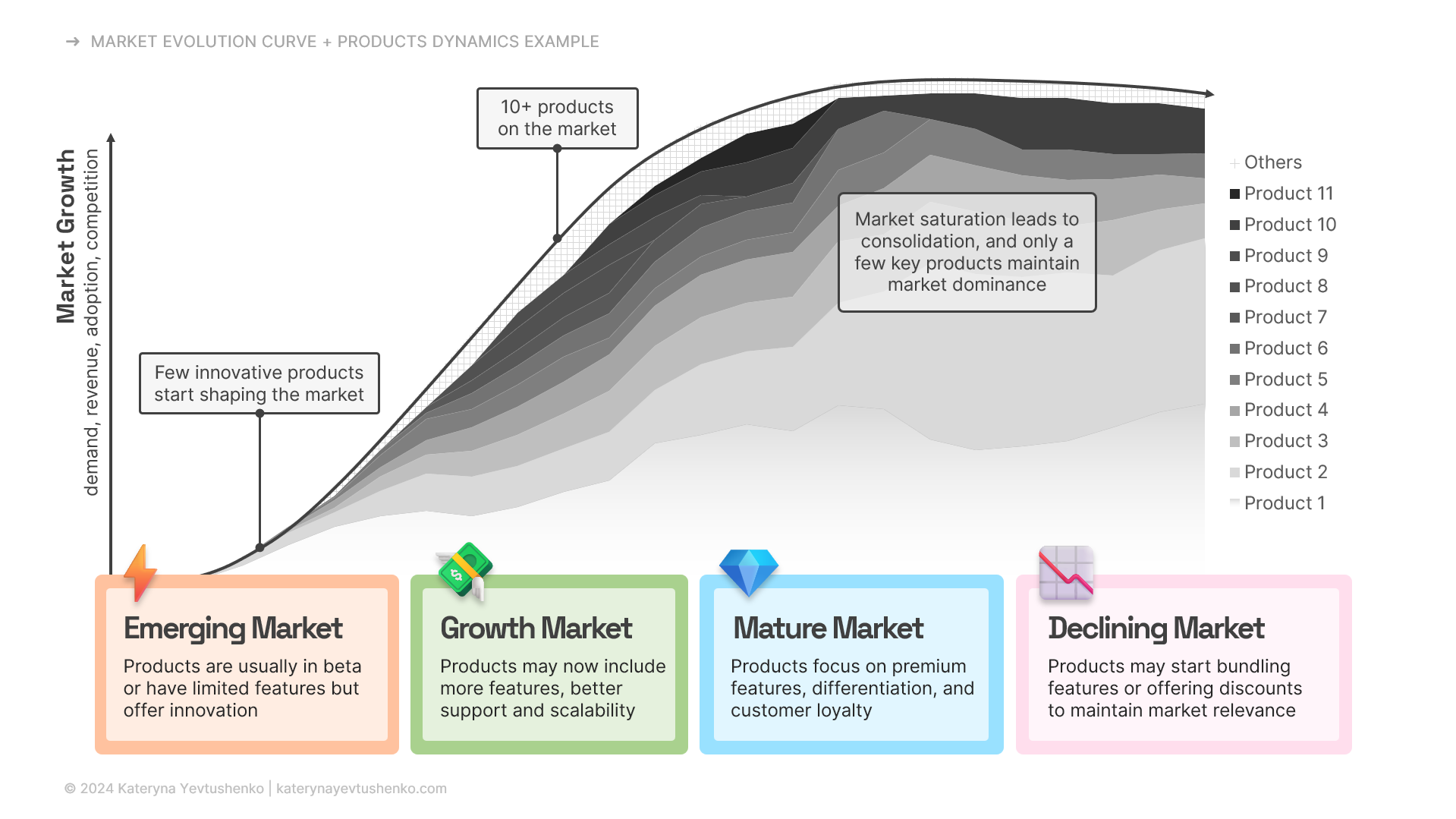

To gain a clearer understanding of how markets typically grow and change, let's take a look at the Market Evolution Curve below. You may also see it referred to as the S-curve.

The Market Evolution Curve is a nice theoretical model that visually represents the typical lifecycle of a market, from early emergence to eventual decline.

Let's go through the main stages and steps.

Emerging market.

Few players ➜ Competition is just beginning to take shape. Innovators and pioneers usually occupy the main positions.

Low customer awareness ➜ Potential customers are often unfamiliar with the products/services or haven’t yet recognized the value. Companies often need to educate the market on why their solutions are necessary.

Significant investments in infrastructure ➜ Early markets require substantial investment in research, development, and foundational infrastructure to support future growth.

High rate of technological innovation ➜ At this stage, there is usually a lot of experimentation, with different technologies and approaches being tested. New solutions can frequently emerge, setting the groundwork for the market’s evolution.

For example, quantum computing is in the emerging phase of its market lifecycle. This stage is characterized by rapid technological advancements, significant investments, and the development of foundational infrastructure.

Another example is the metaverse. For early adopters it might feel like it's everywhere, but analysts project it will likely remain in the emerging phase of development for at least another 5 to 10 years.

The Chasm.

This critical point represents a significant barrier to mass adoption, where many innovations stumble and fail to progress beyond niche audiences. At this stage, early adopters, typically tech enthusiasts or innovators, are no longer enough to drive growth, and the challenge lies in capturing the interest of the more conservative early majority.

Bridging the Chasm often requires a shift in strategy, e.g. simplifying products to meet the expectations of a broader audience or developing targeted use cases that clearly demonstrate value.

For a deeper understanding of this concept and actionable strategies to overcome this hurdle, I highly recommend Crossing the Chasm by Geoffrey Moore.

Growth market.

Rising demand ➜ The market is expanding, and customers are actively seeking solutions. Businesses begin seeing exponential increases in sales, and customer awareness shifts from curiosity to necessity.

Increased competition ➜ Success stories in the emerging phase attract new entrants, intensifying competition. Many vendors enter the space, and differentiation becomes critical. Established players often consolidate their positions, while smaller competitors carve out niches or introduce innovations to disrupt the status quo.

Expansion opportunities ➜ Vendors look to expand into new customer segments, industries, or regions to capture untapped demand. Partnerships, aggressive marketing, and competitive pricing strategies are hallmarks of this phase.

Focus on scaling operations ➜ Rapid growth pressures businesses to scale their infrastructure and operations quickly. This means automating workflows, and improving customer support to meet demand without losing quality.

Customer expectations evolve ➜ As markets grow, customers expect more polished and reliable products. Companies that deliver exceptional customer experiences and evolve their offerings (e.g. new features or better integrations) are better positioned to win the loyalty of this rapidly growing audience.

SaaS in the early 2000s, when companies like Salesforce started scaling rapidly as customer interest surged, was a perfect example of a growing market.

During the pandemic, we witnessed the dramatic growth of the market for cloud-based collaboration tools. Companies like Zoom, Slack, and Microsoft thrived as remote work became the norm, driving a surge in demand. This growth phase was defined by rapid adoption, a flood of new competitors entering the space, and intense efforts to innovate and differentiate in an increasingly crowded market.

Now, in 2024, artificial intelligence, particularly generative AI, is a prime example of a technology market in the growth stage. Since the launch of ChatGPT in November 2022, the sector has seen rapid expansion. In Q3 2024, venture capitalists poured $3.9 billion into 206 generative AI startup deals (excluding OpenAI's monumental $6.6 billion funding round). If anything signals a booming market, it’s numbers like these.

Mature market.

Market saturation ➜ At this stage, most potential customers have already adopted solutions, leaving little room for new growth. Companies fight to retain existing customers and capture market share from competitors.

Intense competition ➜ The market is crowded with competitors offering similar products or services. The focus shifts from rapid adoption to strategic differentiation and customer loyalty.

Focus on differentiation ➜ Companies in mature markets emphasize premium features, superior customer service, or specialized offerings to stand out. Branding and long-term customer relationships become critical.

Price sensitivity ➜ As options increase, customers become more price-conscious, often switching providers for cost savings or better value.

Consolidation ➜ Smaller or weaker players may exit the market or merge with larger ones. The market becomes dominated by a few key players who command the majority of revenue.

The CRM market is a good example of a mature market. As of November 2024, over 2000 CRM products (yes, two thousand!) are listed on Capterra. Industry leaders like Salesforce and HubSpot dominate, while countless smaller players niche out or differentiate themselves through specialized features, pricing strategies, or targeted market segments.

While groundbreaking innovations are rare at this stage (nobody seems to be developing "the next Salesforce"), vendors are enhancing CRM systems with advanced analytics and generative AI tools (e.g. Salesforce Einstein GPT). This demonstrates how technology from younger, fast-growing markets (like generative AI) can drive incremental innovation within mature markets, keeping them competitive and evolving despite saturation.

Declining market.

Shrinking demand ➜ As alternative solutions emerge or customer preferences shift, demand for products in declining markets diminishes. The market contracts, leaving only a handful of players still active.

Increased competition for shrinking market share ➜ With fewer customers remaining, competition becomes fierce. Vendors may resort to aggressive pricing strategies or bundling products to retain existing customers.

Consolidation and exits ➜ To survive, companies might merge with competitors or be acquired by larger players. Alternatively, some businesses may simply pivot to new markets or shut down operations altogether.

Reliance on cost optimization ➜ Vendors focus heavily on reducing costs and squeezing as much value as possible from their offerings. The emphasis shifts to operational efficiency rather than innovation.

The traditional on-premise enterprise software market is a clear example of a declining market. With the rise of cloud-based solutions, companies have increasingly shifted away from costly, inflexible on-premise systems. Giants like SAP and Oracle have pivoted heavily toward cloud offerings to remain competitive, while many smaller providers in this space have either been acquired or exited the market.

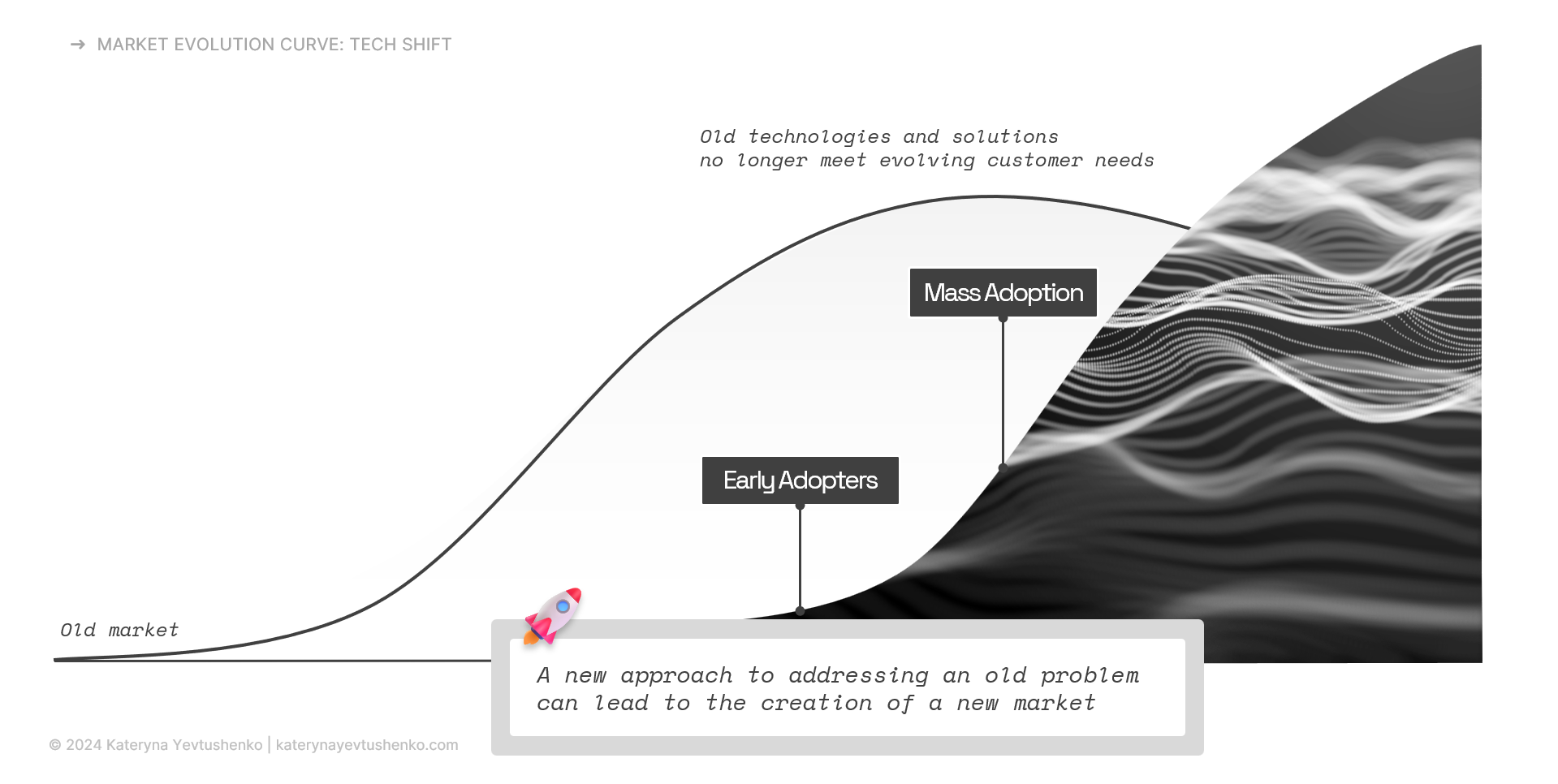

Technology disruption and market shifts.

Markets don’t have to be declining to experience major shifts. Sometimes, even a thriving market can be reshaped entirely by a revolutionary product or technology.

Take the CRM market as an example. In 1999, it was primarily defined by on-premise solutions and was not in decline. However, Salesforce disrupted the landscape by introducing cloud-based CRM. This innovation transformed a growing but niche segment into a mainstream necessity, reshaping the market and paving the way for a multi-billion-dollar industry.

Salesforce's success not only redefined CRM but also inspired the emergence of related SaaS solutions in areas like marketing automation, customer success platforms, and project management tools. This cemented the cloud as a cornerstone of modern business technology as we know it today.

Fast-forward to 2024, and we see a similar transformation happening with AI. From my perspective, OpenAI is mirroring the disruptive impact Salesforce had in the early 2000s. By leading the way in generative AI, OpenAI is also reshaping adjacent markets, just as Salesforce did two decades ago.

This illustrates that market evolution can be better understood as a continuous layering of innovations, like waves building upon one another.

When analyzing your market’s evolution, always keep an eye on the bigger picture. Adjacent markets and emerging technologies can create ripple effects that radically reshape your market.

Ask yourself:

➜ Is there a disruptive technology on the horizon that could redefine customer expectations?

➜ How can we adapt or leverage these changes to stay ahead?

It's worth noting that factors like regulations and economic changes can also play a pivotal role. Being aware of these forces can help you anticipate shifts and adapt accordingly.

Indicators to Spot Where Your Market Stands.

So far, we've explored the typical stages of market evolution and indicators that help identify where a market stands in its lifecycle.

While there are many indicators you could use to analyze a market, two of the simplest and most accessible ones are customer adoption and the number of products available.

These indicators don’t require complex tools or specialized expertise, and they can quickly provide valuable insights into your market's trajectory and current state. The lower these numbers, the earlier the market is in its lifecycle. Conversely, higher numbers often indicate a more mature or even saturated market.

To give you a better idea, here’s a summary table. Please note that these numbers are illustrative and meant to serve as general examples rather than absolute benchmarks.

| Market Stage | Adoption Rate | Number of Products* |

|---|---|---|

| Emerging Market | <15% | <10 |

| Growth Market | 15-50% | 10-100 |

| Mature Market | 50-80% | 100-500 |

| Market Saturation | 80-90%+ | >500 |

*Market entry barriers such as regulatory requirements or high development costs can limit the number of players. Low barriers mean anyone can jump in, creating a crowded market quickly. High barriers often indicate a market that will take longer to mature but may have more stability.

But rather than just talking theory, let’s look at a concrete example.

To illustrate how these indicators can be used to analyze a market's evolution, let’s take the CRM market (as I've already mentioned it several times in this post).

Customer adoption.

While primary research is the most reliable option, don't worry: two simple yet powerful tools, Google and ChatGPT, can help you analyze customer adoption effectively.

Sounds straightforward, but let’s break it down.

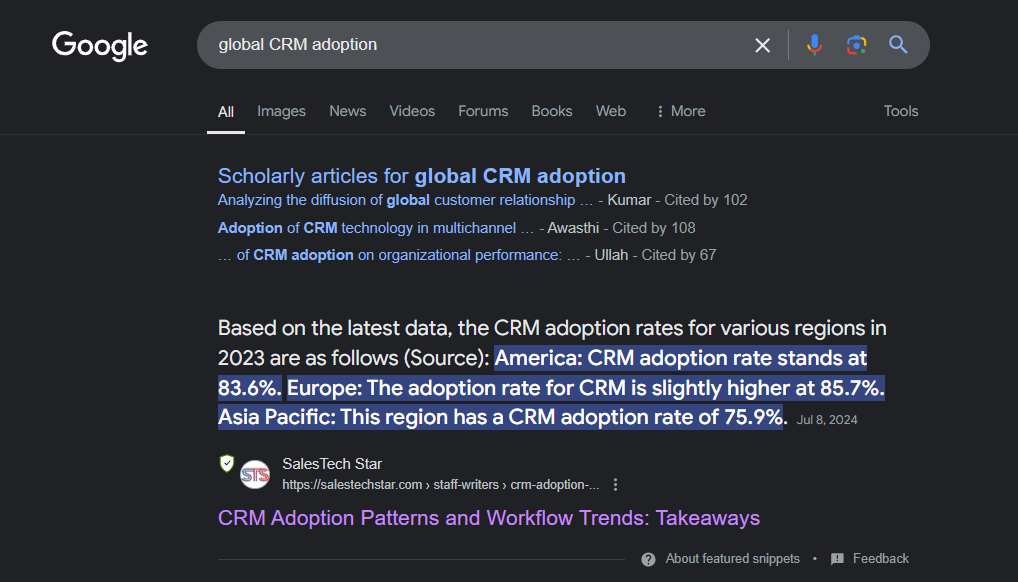

Just Google it.

A quick Google search for "global CRM adoption" led to an article from SalesTech Star, published in July 2024. Here’s what it reported:

91% of companies with over 11 employees have adopted CRM software.

America: CRM adoption rate stands at 83.6%.

Europe: The adoption rate for CRM is slightly higher at 85.7%.

Asia Pacific: This region has a CRM adoption rate of 75.9%.

Given that 100% is the maximum adoption rate, these numbers suggest that the CRM market is mature and nearing saturation.

However, before taking these numbers at face value, it’s essential to evaluate the reliability of the source. For instance, if SalesTech Star is new to you (as it is for me), it’s worth checking its credibility.

A quick check on SimilarWeb shows that as of October 2024, https://salestechstar.com/ received over 15K monthly visits (up 7.3% from September). The site’s primary audience is from the US, UK, India, Canada, and Germany.

With this additional context, does the data feel more credible to you? If not, it may be worth further exploring other sources to cross-check these figures.

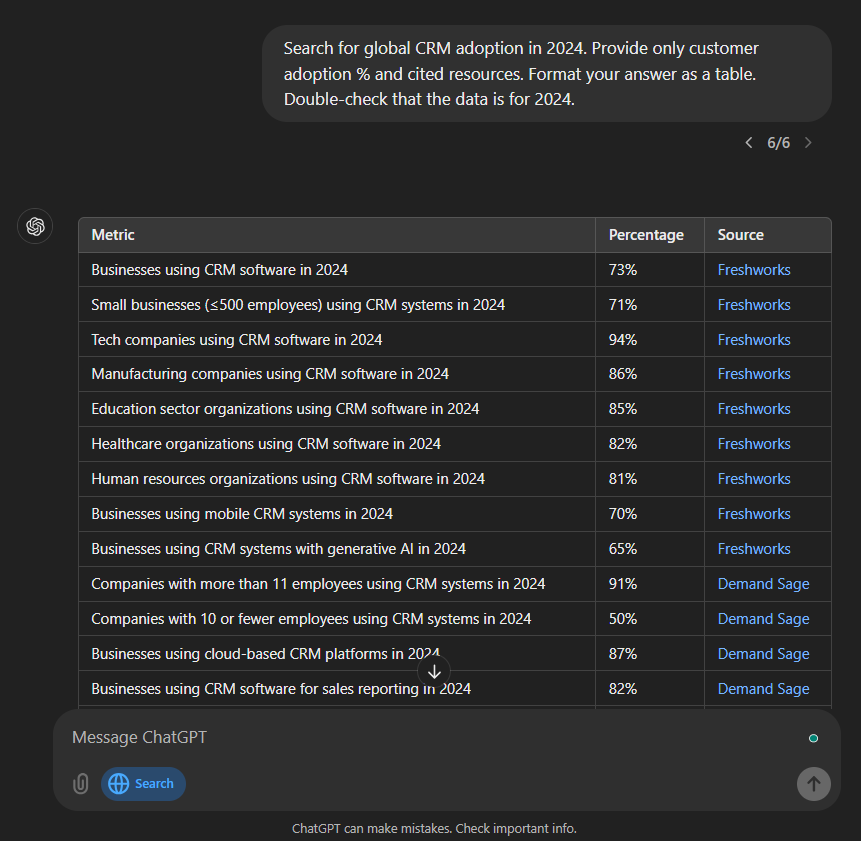

ChatGPT search.

Let’s move to the second tool, ChatGPT, to see how it can complement Google in analyzing market adoption.

Please note, that I'm using the ChatGPT search available in paid plans.

Here's the prompt I used: "Search for global CRM adoption in 2024. Provide only customer adoption % and cited resources. Format your answer as a table. Double-check that the data is for 2024."

And here are some stats I got:

| Metric | Percentage | Source |

|---|---|---|

| Businesses using CRM software in 2024 | 73% | Freshworks |

| Small businesses (≤500 employees) using CRM systems in 2024 | 71% | Freshworks |

| Tech companies using CRM software in 2024 | 94% | Freshworks |

| Companies with more than 11 employees using CRM systems in 2024 | 91% | Demand Sage |

| Companies with 10 or fewer employees using CRM systems in 2024 | 50% | Demand Sage |

| Businesses using cloud-based CRM platforms in 2024 | 87% | Demand Sage |

The first step is to verify that these aren’t AI hallucinations. By following the links we can confirm these stats are accurate.

Good, but what about source reliability?

Freshworks is a leader in the CRM space and frequently conducts research in this area, making it a strong source for this data. Demand Sage, with nearly 300K monthly visitors and a focus on business insights, also seems promising for data quality.

Thus, here's what we've found:

73% companies use CRM software.

94% tech companies use CRM software.

91% of companies with over 11 employees use CRM software.

Given these high adoption rates, we can conclude that the CRM market is nearing saturation, with the tech sub-segment especially close to full adoption.

But what if you’re analyzing a newer market, one without extensive data or articles like the CRM space? In such cases, tracking how the number of available products changes over time can provide valuable insights.

Number of products.

If you read the first post in this series, you might recall review platforms like G2 and Capterra as valuable sources for assessing vendor presence in a specific market.

In practice, Capterra often has the most extensive listings. Since its acquisition by Gartner in 2015, Capterra’s reach and credibility in the B2B software marketplace may have grown, encouraging more vendors to list their products there.

So, as I've already mentioned, as of November 2024 over 2000 CRM products were listed on Capterra. This number alone can give a sense of the market's breadth, but how can you see how this figure has evolved over time?

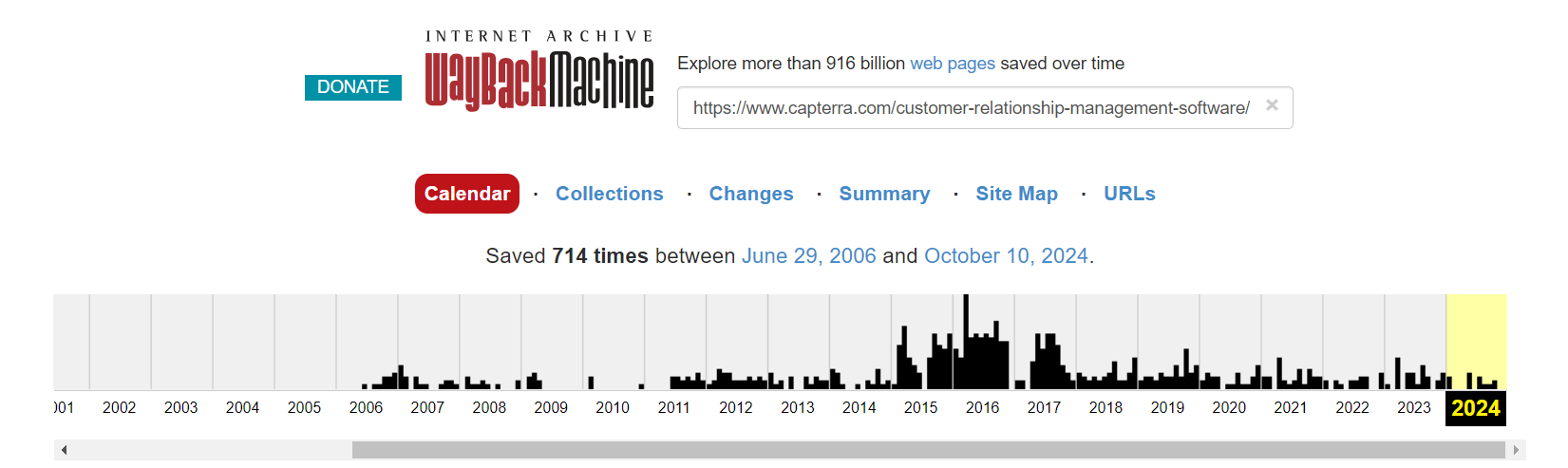

Tracking historical changes: Wayback Machine.

Now, let me share a tool that's perhaps the most invaluable (and somewhat controversial) in a market analyst’s toolkit: the Wayback Machine.

I remember back in 2014, just two months into my role as a Product Marketing Analyst, my manager assigned me a project to analyze a competitor’s website structure and positioning changes over time. When I asked, “How do I look into the past?” the answer was Wayback Machine. This tool allows you to view archived versions of almost any publicly available webpage.

However, like any web crawling tool, use the Wayback Machine with caution. It’s excellent for internal analysis, but be mindful when using it for public-facing insights. And, of course, never use it to harm or undermine anyone. In any case, consult with your legal team if you’re uncertain about ethical boundaries.

Back to our CRM research.

To track product numbers over time, let's take the URL for CRM listings on Capterra https://www.capterra.com/customer-relationship-management-software/ and enter it in the search bar at Wayback Machine.

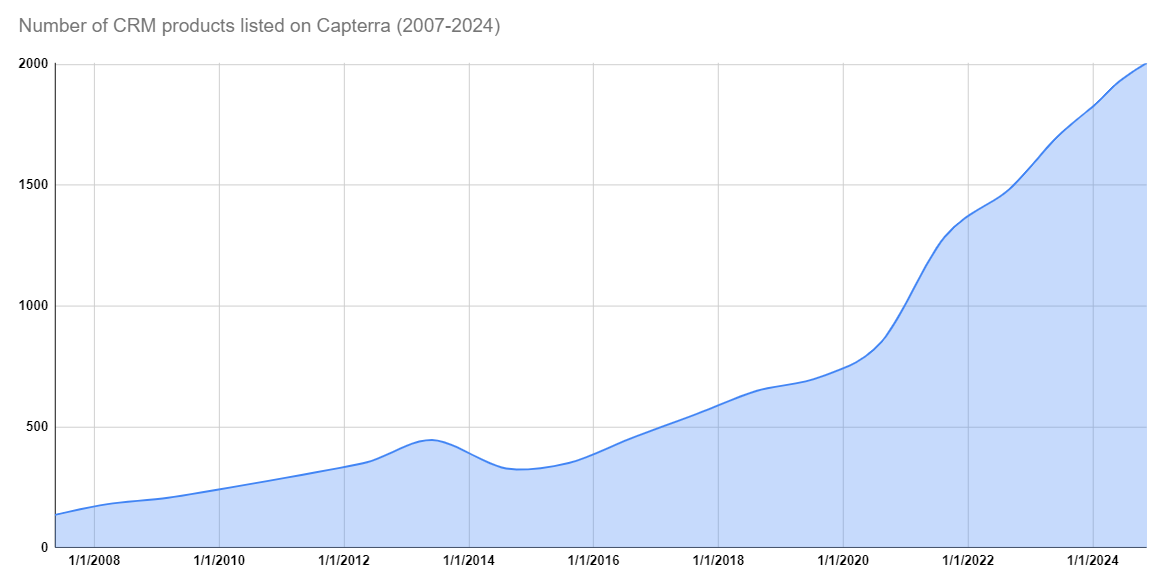

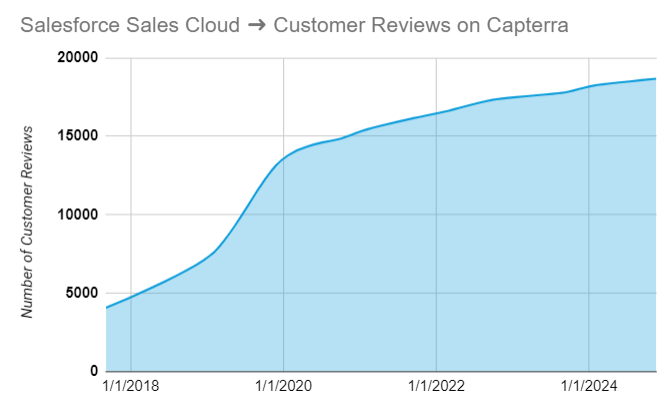

You can then access snapshots of this page going back as far as 2006, allowing you to see how the number of CRM listings has changed. Based on this data, you could create a chart similar to the one below to visualize growth over time, which may help indicate whether the market is expanding or stabilizing.

This chart illustrates the growth in the number of CRM products listed on Capterra from 2007 to 2024.

We see a gradual increase in listings until around 2018, after which growth accelerates significantly. The upward trend continues steadily, with a particularly steep rise from 2020 onward, indicating rapid market expansion. In 2024, the number of listed products has surpassed 2000, signaling a highly saturated market with a wide range of choices for potential buyers.

Thus, we can conclude that the CRM market is still growing (at least in terms of number of products offered). However, based on the customer adoption data we examined earlier, the influx of new products may slow as the market gets closer to saturation.

Now, it's your turn.

Use tools like Google and ChatGPT to find adoption rates. Cross-check the credibility of your sources and identify whether the market is in its early stages, growing rapidly, or nearing saturation. High adoption rates indicate a mature market, while low rates suggest early-stage opportunities.

Use review platforms like G2 or Capterra to gauge competition. For historical trends, leverage tools like the Wayback Machine to understand how numbers have changed over time. A rapidly increasing number of vendors indicates market growth, while stabilization could mean the market is maturing.

Finally, ask yourself:

➜ What does this mean for our product’s positioning or market potential?

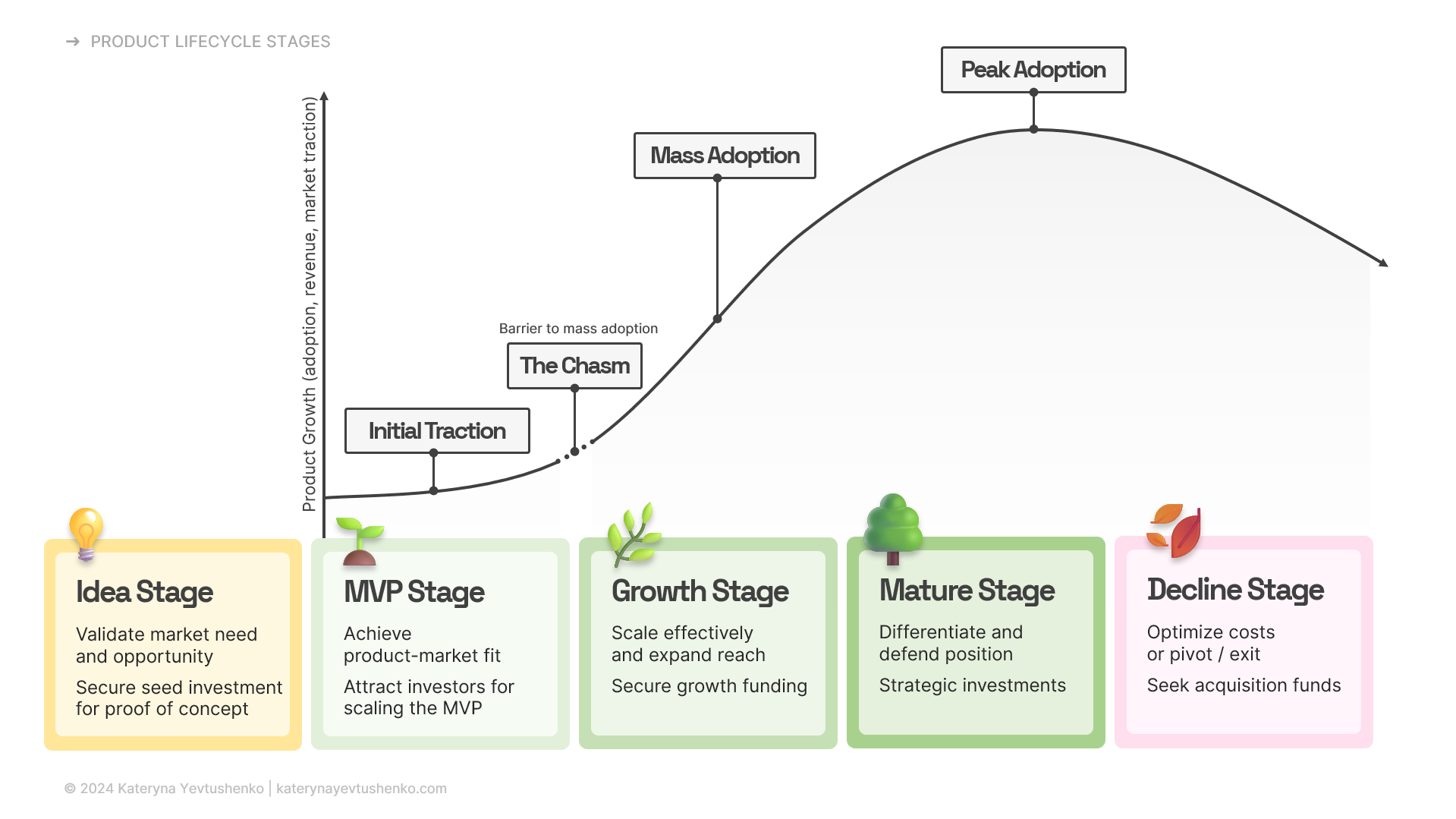

Product Lifecycle Curve.

Now, here’s the thing: it’s not just the market that evolves, your product and your competitors' products go through their own lifecycles.

And just as there’s a curve for markets, there’s also a curve that maps the typical evolution of a product.

Idea stage.

This is where everything begins, whether it’s in someone’s garage, a dorm room, or a high-profile corporate meeting room.

At this point, the focus isn’t on fancy marketing or operations (because it's a pre-market stage basically). It’s about validating your brilliant (or not-so-brilliant) idea. Is there a market? Does anyone care? And can you sell the vision well enough to secure funding for your proof of concept?

MVP stage.

The "let’s see if anyone actually wants this thing" phase.

The goal here is to launch your minimum viable product, a good enough version of your product with just enough features to solve your audience’s pain point.

The focus here is all about achieving product-market fit. That means listening carefully to early adopters, gathering feedback, and fine-tuning until your product resonates.

This is also the time to charm some investors (whether internal or external) to secure the funds you’ll need to scale.

The Chasm.

Yes, again :)

Just like we saw in the market evolution section, the chasm represents a significant barrier in any product's lifecycle. It's a make-or-break moment where many new products fail.

Early adopters, those tech-savvy enthusiasts and innovators who embraced your product with excitement, are no longer enough to sustain momentum.

To move forward, your product must resonate with the larger, more conservative segment of the market. This group won’t take a leap of faith. They need reviews, testimonials, case studies, and industry validation to feel confident in their decision. Thus, the focus should be on practicality, reliability, and shift from "look how innovative this is" to "here’s how this will make your life easier."

Remember Google Glass? Since its launch in 2013, it has struggled to move beyond early adopters. Despite multiple relaunches and pivots over the years, Google Glass never quite made the leap to mainstream success, illustrating how difficult it can be to cross the Chasm and gain widespread acceptance (even with all the resources that Google has).

If you’re navigating this stage, ask yourself:

➜ Are our features intuitive enough for non-tech-savvy users?

➜ Have we tested messaging and positioning to ensure it resonates with a more conservative audience?

Crossing the chasm isn’t easy, but for those who succeed, it’s the gateway to the growth stage and all the opportunities that come with it.

Growth stage.

You’ve validated your product-market fit, and now it’s all about scaling up. That means expanding your reach by targeting new customer segments, industries, or even breaking into new regions.

Demand is rising, competition is intensifying, and your efforts should center on refining operations, delighting customers with the best experience, and securing additional funding to keep up with growth.

This is the time for strategic partnerships, bold marketing moves, and rolling out constant product updates to stay one step ahead of your rivals.

Mature stage.

This is the stage where your product has reached stability, and you’re now in a crowded market where everyone offers something similar.

Growth has plateaued, and the game has shifted from rapid expansion to retaining customers and maximizing value.

This is where you double down on differentiation: premium features, killer customer service, and exclusive perks to keep your audience loyal.

Consolidation is also common, with weaker players exiting or merging, leaving a few dominant players shaping the market. And you want to be among them.

Decline stage.

This stage signals a downturn in the product's lifecycle. Demand is fading, and newer, shinier solutions are taking over. So what now?

Smart companies use this phase to pivot, optimize costs, or milk the product for everything it’s worth. Maybe you bundle it with other offerings, target niche customers, or even sell the business outright.

Pause and pinpoint where your product truly stands.

Ask yourself:

➜ Are we focused on the right priorities? Are our efforts aligned with where our product is in its lifecycle?

➜ What’s holding us back? Is it funding, customer awareness, competition, or internal inefficiencies?

Ways to Analyze Product Lifecycle Stages.

You likely have a good understanding of your product's lifecycle. At least, I hope so :)

But what about the products of your competitors? How do you determine where they stand?

Here are some key indicators to analyze where any product stands in its lifecycle.

Product age and update history.

The timing of a product’s initial release and subsequent updates can be a reliable indicator of its lifecycle stage. For example, if a product was launched a decade ago, it’s highly unlikely to still be in the MVP stage.

Here’s a way to interpret product timelines:

MVP Stage ➜ Products in this stage are newly launched, with frequent updates as teams iterate based on user feedback.

Growth Stage ➜ Typically, products in this stage have been on the market for some time. They may see regular feature rollouts to meet growing market demands and outpacing competitors.

Mature Stage ➜ Updates may slow down, focusing on incremental improvements, premium add-ons, or optimization of existing features rather than introducing groundbreaking innovations.

Decline Stage ➜ If updates have become rare with the focus shifting to maintenance, or stopped altogether, it may be a sign of decline.

How to track this?

The quickest way would be to search on Google or use ChatGPT for an initial idea. But double-check those findings by going through the official sources:

- Look for press releases to determine when a product was first introduced.

- Check release notes or version logs on official websites, app stores, or forums to identify how frequently updates occur and their focus (new features vs. bug fixes).

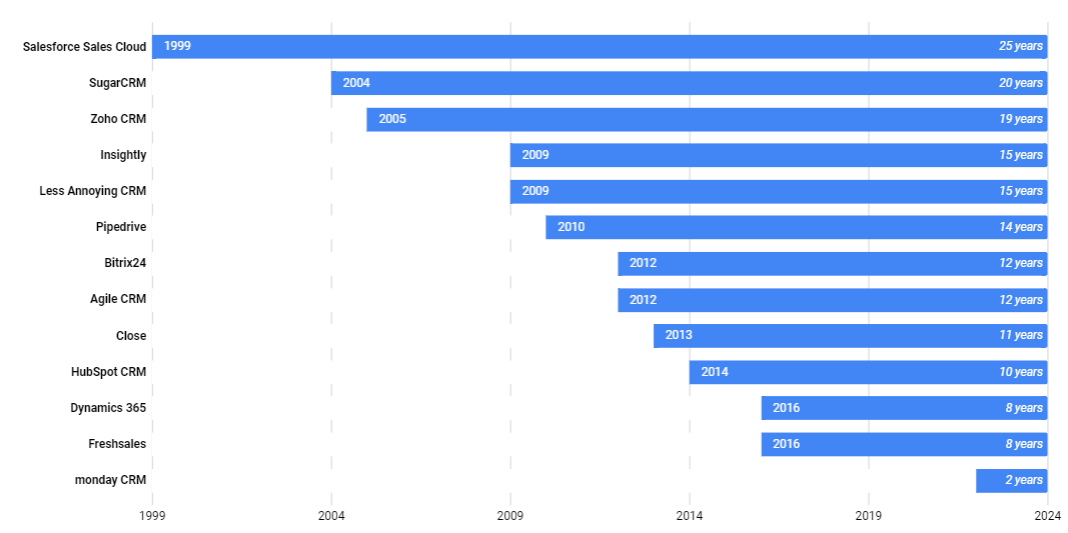

And to keep things practical, let’s once again turn to the CRM market.

The chart below shows the launch dates of various CRM products and how many years they’ve been on the market. Of course, this is just a small sample (as we know, there are over 2000 CRM products out there), but it’s enough to draw some insights.

What can this chart tell us?

Salesforce Sales Cloud has been around for an impressive 25 years. This clearly signals that it’s a mature product. Naturally, we can expect it to offer a broader range of features compared to newer products like monday CRM, which launched just two years ago, for example.

But 25 years is a long time. How can we be sure Salesforce Sales Cloud hasn’t entered the Decline Stage yet? This is where product updates come into play. Release notes for product updates are a great way to see whether a product is evolving or simply being maintained.

For instance, Salesforce has been actively enhancing its AI capabilities in recent years. The launches of Einstein GPT in 2023 and Einstein Copilot in 2024 are clear signs of ongoing innovation and adaptability. This shows that, despite its age, Salesforce continues to adapt to market needs and remains a strong, competitive player in the CRM space.

So, even with limited indicators like product age and recent updates, we can deduce that Salesforce Sales Cloud is a mature product that remains highly relevant. That’s exactly what you’d expect from a market leader, right?

Similarly, analyzing the age and update history of other products can help you understand where they stand in their lifecycle and how they compare in terms of innovation and competitiveness.

Take a moment to reflect on where your competitors' products stand.

➜ How frequently are updates or innovations happening? Do these updates indicate growth and relevance, or mere maintenance?

Customer reviews and their evolution.

The number of customer reviews can give you a quick idea of where a product is in its lifecycle. While it’s not perfect, it’s a fast way to gauge market traction.

Here’s how to interpret review counts:

MVP Stage ➜ Few reviews, mostly from early adopters.

Growth Stage ➜ Reviews start growing quickly as more users adopt the product. Feedback may include feature requests and comparisons to competitors.

Mature Stage ➜ Lots of reviews, but growth in review numbers slows. Feedback may focus on fine-tuning, customer support, and pricing.

Decline Stage ➜ Fewer new reviews appear, and existing ones may highlight outdated features or dissatisfaction compared to other products.

How to track this?

- Look at platforms like G2 or Capterra to see how many reviews a product has.

- Check how the number of reviews has grown over time using tools like the Wayback Machine.

- Analyze reviews to see what users are focusing on. Is it early enthusiasm, feature requests, or complaints?

I know you’re probably thinking, "Not CRM again!" :)

But hang in there, this time we’re diving into customer reviews, and they can reveal a lot!

Let's see if the change in Salesforce Sales Cloud’s customer reviews can provide insight into its lifecycle.

Looking at the chart, we can see trends that correlate with lifecycle stages. From steady growth pre-2020 to a more stable plateau in recent years.

This suggests that Salesforce Sales Cloud entered the Mature stage, with its large, loyal customer base driving consistent review numbers.

Take a moment to evaluate what customer reviews reveal about your competitors’ products.

➜ What do the reviews say about customer satisfaction? Are there recurring complaints or praises that highlight key strengths or weaknesses?

Customers and revenue (and how they changed).

The size and growth of a product’s customer base, alongside its revenue trajectory, are strong indicators of its lifecycle stage. While exact numbers can be hard (sometimes impossible) to find, patterns can help you estimate where a product stands in its lifecycle.

Here’s how to interpret customer and revenue growth:

MVP Stage ➜ Products in this stage typically attract a small but passionate group of early adopters, and revenue is often minimal or inconsistent as the focus is on testing and refining the product.

Growth Stage ➜ A rapid increase in customer numbers and revenue signals successful scaling and strong market demand. Revenue growth is often exponential during this stage as new segments and geographies are tapped.

Mature Stage ➜ The customer base stabilizes as most potential users have already adopted the product. Revenue growth slows, plateauing as the product reaches its saturation point in the market.

Decline Stage ➜ A noticeable drop in customers and declining revenue often suggest the product is becoming obsolete, facing competition, or losing relevance.

How to track this?

Again, the easiest way would be to search on Google or use ChatGPT for some initial insights. But double-check those findings by going through the official sources:

- Check competitors’ websites for user counts or revenue milestones on customers' pages, press release (or newsroom) pages, or blog posts.

- Look for financial statements or press releases highlighting customer milestones, quarterly earnings, or revenue achievements. Public companies often share this information transparently.

- Use industry reports or third-party research to estimate user numbers and revenue trends. Reports from analysts or consultancies can provide aggregated insights if direct data isn’t available.

- Pay attention to funding rounds for startups or private companies. Valuation increases may reflect rising customer and revenue growth.

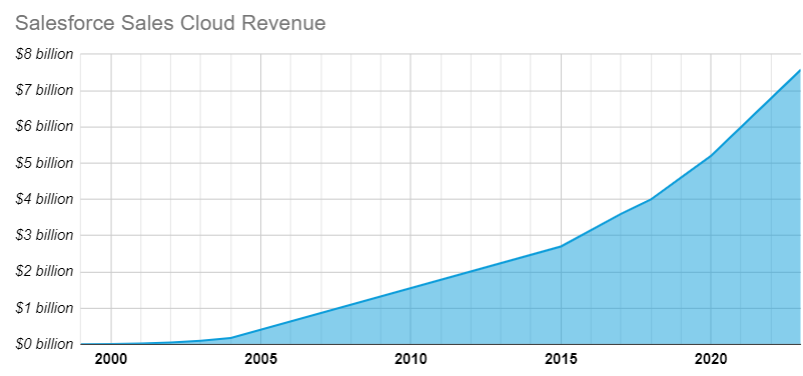

Missed CRM examples? I got you covered (just kidding). But seriously, let's look at Salesforce Sales Cloud again.

Take a look at the chart below. It tracks Salesforce Sales Cloud's revenue growth over the years, and it’s pretty revealing.

From the early 2000s, you can see a slow start, this is what you'd expect in the MVP stage. Then, as Salesforce gained traction, its revenue took off, hitting its stride during the Growth stage. Fast-forward to 2024, and with revenue now surpassing $7 billion, Salesforce Sales Cloud is a good example of a mature (yet growing) product.

Now, you’re probably wondering: how do you gather data like this? It’s easier than it sounds (for public companies, at least).

Here are some tips:

- Check annual reports for publicly traded companies, they’re a goldmine of financial (and strategic) data.

- Review press releases or investor updates for milestones and financial achievements.

- For private companies or startups, dig into industry analyses or news articles for revenue estimates.

For the Salesforce example, I used two simple sources: The History of Salesforce article and annual reports available on the Financial page.

Now (you guessed it), it’s your turn.

Take a closer look at the customer base or revenue growth of your key competitors. Ask yourself:

Is their growth outpacing yours? If so, what might they be doing differently?

Market share shifts.

Whether a product is gaining, holding steady, or losing ground tells you a lot about its position in the market.

Here’s a possible way to interpret market shares:

MVP Stage ➜ The product has little to no market share as it’s just entering the market.

Growth Stage ➜ Possible growth in market share as the product gains momentum and attracts more customers, often outpacing competitors.

Mature Stage ➜ Market share stabilizes as the product becomes a key player in the market. Shifts in share occur mainly through intense competition or consolidation.

Decline Stage ➜ A shrinking market share indicates that the product is losing relevance, either due to competition or a declining market.

Market share data can be tricky to find, especially for smaller markets or products. However, here are some approaches:

- Look for industry reports (e.g. Gartner, Forrester, or IDC) that rank vendors by market share.

- Watch for competitor press releases boasting about market dominance or reaching key milestones.

- Use tools like Statista to gather comparative data.

- Check news articles discussing industry trends to piece together the current landscape.

Salesforce Sales Cloud, shall we? :)

Let’s turn to Salesforce Sales Cloud for yet another case study. While finding precise market share data for every year can be challenging, we know Salesforce has consistently been a CRM market leader. Reports from Gartner's Magic Quadrant and IDC have confirmed its dominance for over a decade.

In 2023, Salesforce held a 21.7% share of the CRM market, outpacing every other vendor in revenue, according to IDC.

What does this tell us? We already suspected this, but here’s further evidence: Salesforce Sales Cloud is firmly in the Mature Stage of its lifecycle. Its strong market share, steady revenue growth, and ongoing leadership in the CRM space leave little doubt.

Now, your turn.

Take a moment to reflect on how market shares are divided among the players in your market:

➜ Are market shares shifting? Who’s gaining ground, and who’s losing? What does this tell you about emerging trends or competitive dynamics?

Aligning Product and Market Dynamics.

Now, let's bring it all together.

If you followed all the practical exercises you probably should be able to visualize how your market changed over time.

It can look similar (or not so much) to the chart below.

In this particular example, it illustrates:

- how a few innovative products drove early growth (Products 1 and 2),

- a wave of similar offerings fueled expansion (Products 3-11 and other products with smaller market shares),

- and, ultimately, only a few dominant products (Products 1 and 2) maintain relevance as the market consolidates.

Every product has its story, and every market has its rhythm.

Sometimes they align, moving through the same stages. Other times, they’re completely out of sync: products in decline within a growing market, or emerging ideas trying to disrupt a saturated space.

But here’s the thing: regardless of the stage your product or market is in, success isn’t about doing everything, it’s about doing the right things at the right time.

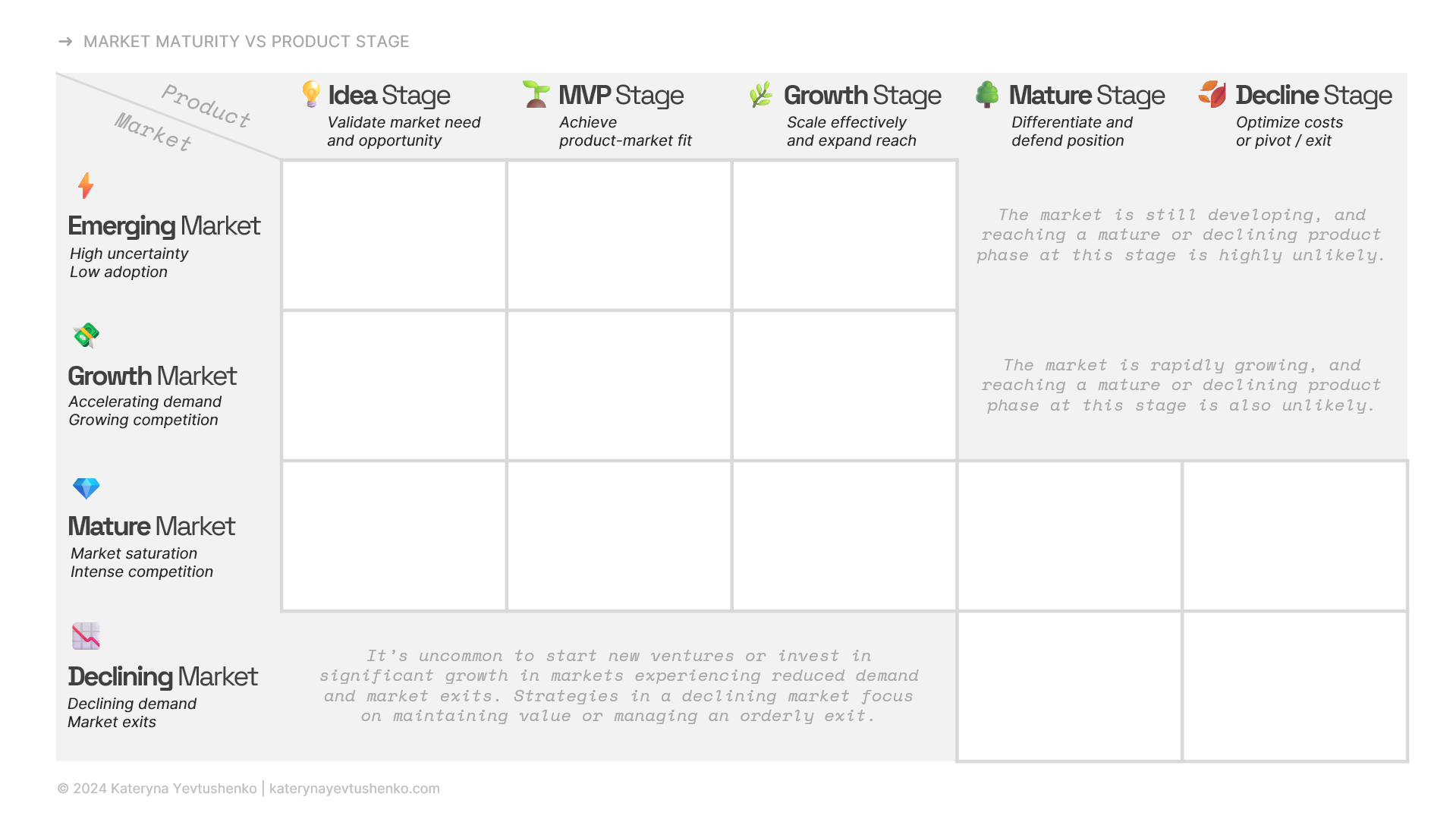

But what are the right things? More importantly, what’s right for your product?

It’s a question that deserves hours of research and brainstorming.

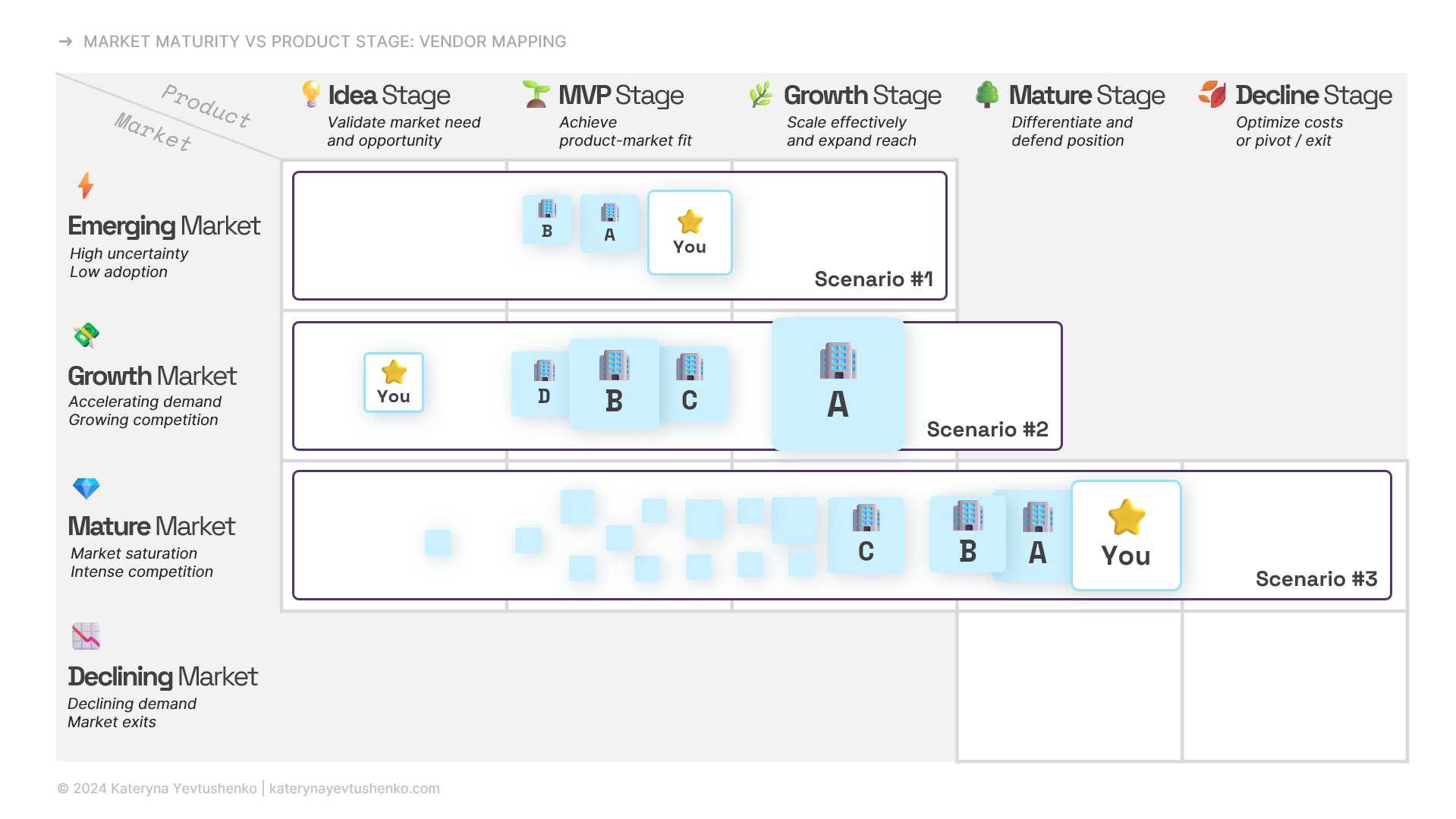

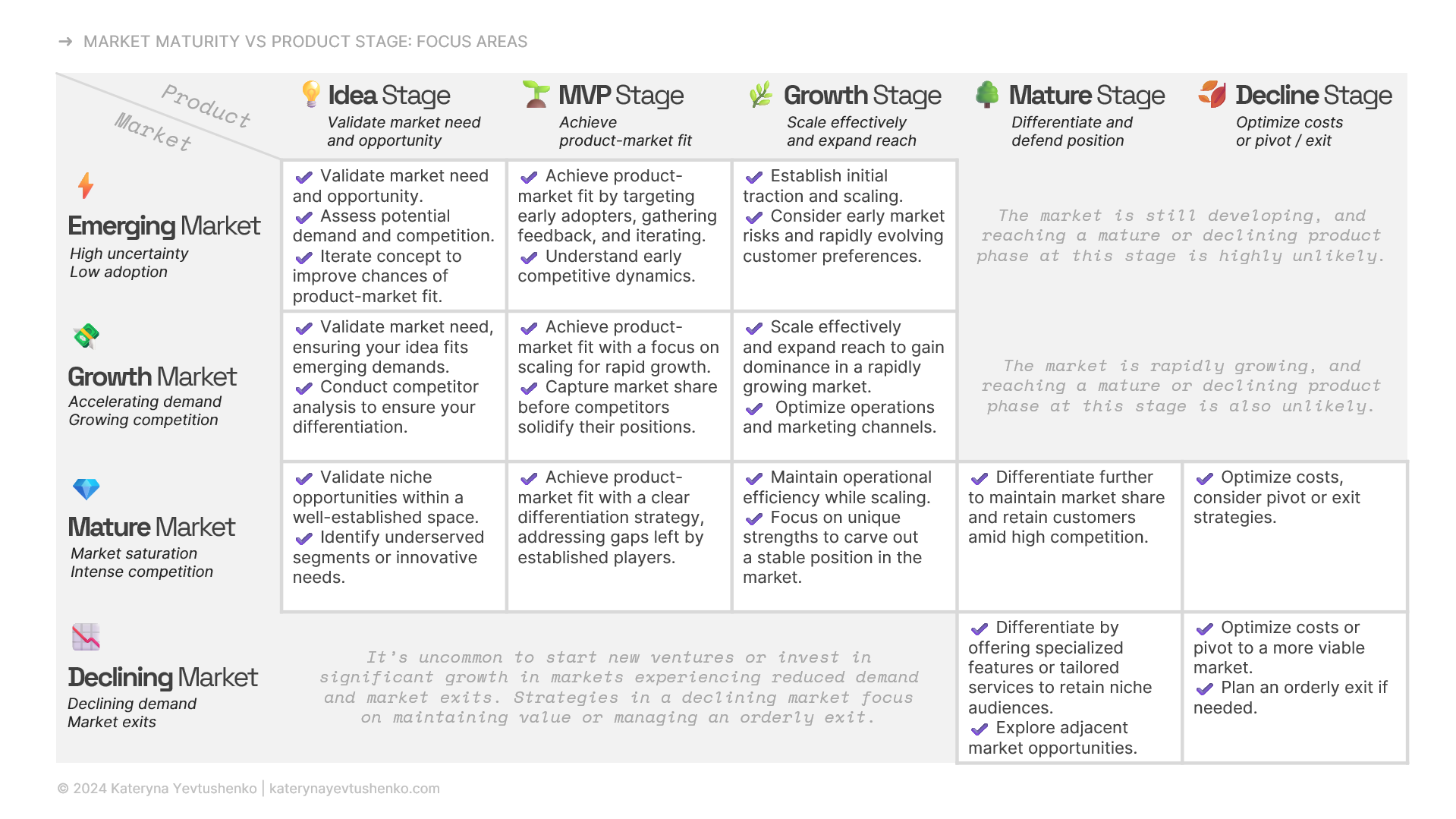

However, you can take the first step by mapping your product, and those of your competitors, onto the table below.

Such mapping can reveal valuable insights into your positioning and strategy. Below are some common scenarios.

Scenario #1: Innovating in an Emerging Market.

In this scenario, you’re in the MVP stage, alongside other players (A and B), within an emerging market. This phase is marked by high uncertainty and low adoption. Your focus should be on achieving product-market fit quickly while differentiating yourself from competitors before the market evolves.

Scenario #2: Competing in a Growth Market.

In this scenario, you are in the Idea Stage while operating within a rapidly expanding market. Competitors like B, C, and D are in the MVP Stage, working on achieving product-market fit. Meanwhile, an established player like A has already advanced to the Growth Stage, dominating the market.

This case requires careful analysis of competitors, identifying gaps they’ve left unaddressed, and designing a unique value proposition. It’s a challenging position, but entering a growth market with a well-researched idea can set the stage for future success.

Scenario #3: Standing Out in a Mature Market.

Here the market is saturated, and competition is fierce. You’ve managed to establish a strong presence, but so have others like A and B. Success now hinges on defending your position through differentiation, innovation, and operational excellence.

These mock scenarios illustrate how understanding the interplay between product and market dynamics can guide your strategy at every stage.

To refine your strategy further, take a look at the table below. It can serve as a practical guide to aligning your strategy with your product and market evolution. Whether you’re launching an MVP in an emerging market or navigating the challenges of a mature one, it gives a general idea of where your focus could be.

So there you have it.

Understanding B2B market evolution is about seeing the big picture and aligning it with your product’s lifecycle. From emerging markets to mature or even declining ones, knowing your position empowers you to make smarter strategic decisions.

Stay flexible, keep a close eye on your competitors, and proactively adapt to maintain your competitive edge.

P.S. If you’d like the mapping table in an editable format, let me know in the comments below, I’d be happy to share!

Disclaimer: I am not affiliated with any of the tools or products mentioned in this post, and the links provided are not referral links. Any analysis or insights shared in this post are intended solely for educational purposes and should not be construed as financial or strategic advice.