B2B Market Analysis: Uncover Your Market Structure Like a Pro

An actionable roadmap for navigating the tech B2B landscape: customers, competitors, influencers, and everything in between.

In B2B, detailed market analysis often takes a backseat to immediate sales goals and quick fixes, which is understandable, especially in tech with its growth hacking mentality.

But if you feel that relying on fragmented data isn't a sustainable strategy for your business, let me share a structured market analysis framework with you.

Before we dive in, let’s agree on a few key definitions.

Market

A market is a physical or digital space where buyers, facing a specific problem or a common set of problems, select sellers that provide solutions to those problems.

In the context of B2B tech, buyers are generally companies of various sizes (e.g. small businesses, mid-market companies, or large enterprises) with specific challenges or needs.

Sellers, on the other hand, are typically tech vendors — companies that provide the necessary products or services to address those challenges.

If you're on the vendor side, this post is for you.

Market Analysis

Market analysis helps you understand your market and make informed decisions.

Short and sweet. But in reality, market analysis is a lengthy process that may span weeks or even months (and, honestly, it never really ends).

We can approach market analysis from three fundamental perspectives:

- Market structure [covered in this post] ➜ What does your market look like at a given time?

- Market evolution over time ➜ How did your market come to its current state?

- Market interconnectivity ➜ How do trends in other markets affect your market?

Market Structure.

Now that we've covered the key definitions, let's dive into the first pillar: market structure analysis.

In B2B tech, market structure can be broken down into three key areas:

- Demand Side ➜ Your customers and your competitors’ customers.

These are businesses of various sizes, often operating in different industries. - Supply Side ➜ Vendors: you and your competitors; system integrators (SIs), value-added resellers (VARs), channel partners, and more.

This includes all vendors and ecosystem partners that contribute to the market. - External Influencers ➜ Regulators, analysts, investors, etc.

These entities define regulations, set trends, and influence market perceptions.

Customers.

What do they want?

Is the market potential large enough to justify your efforts?

If you know the answers to the questions above, you can likely skip this section and move directly to the supply side.

If not, let me share some ideas to get you started.

Identify your target customers.

The goal is to understand the industries they operate in, the size of these companies, and their geographic distribution. Also, identify the number of businesses that fit your target profile based on industry, size, and location. This will provide a clearer view of your market size and potential.

⚙️ RESOURCES

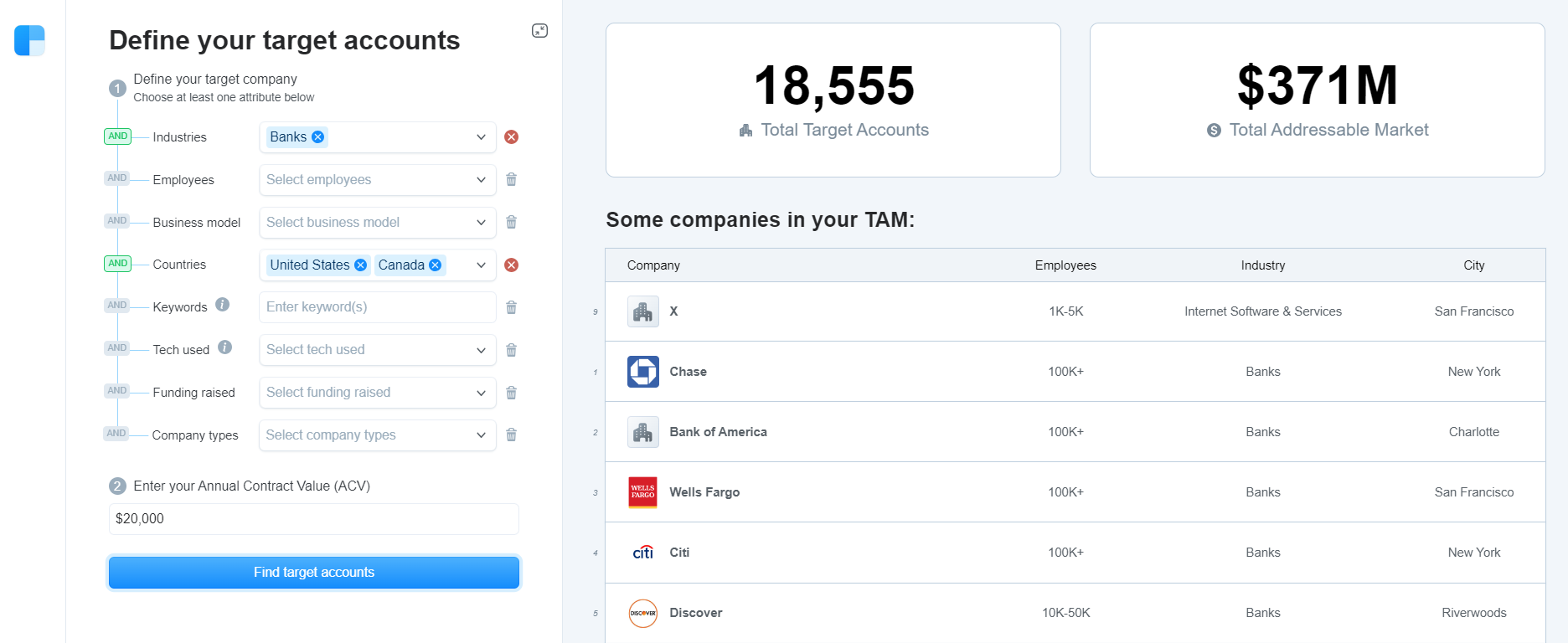

Clearbit TAM Calculator

💲Free

Helps estimate the total number of companies in your target market and provides filters by company size, industry, location, technology used, keywords, etc. Once you know the annual contract value in your market (average spending), this tool can also estimate the TAM for you.

Here’s a guide by Clearbit on how to use their TAM calculator in the best way possible.

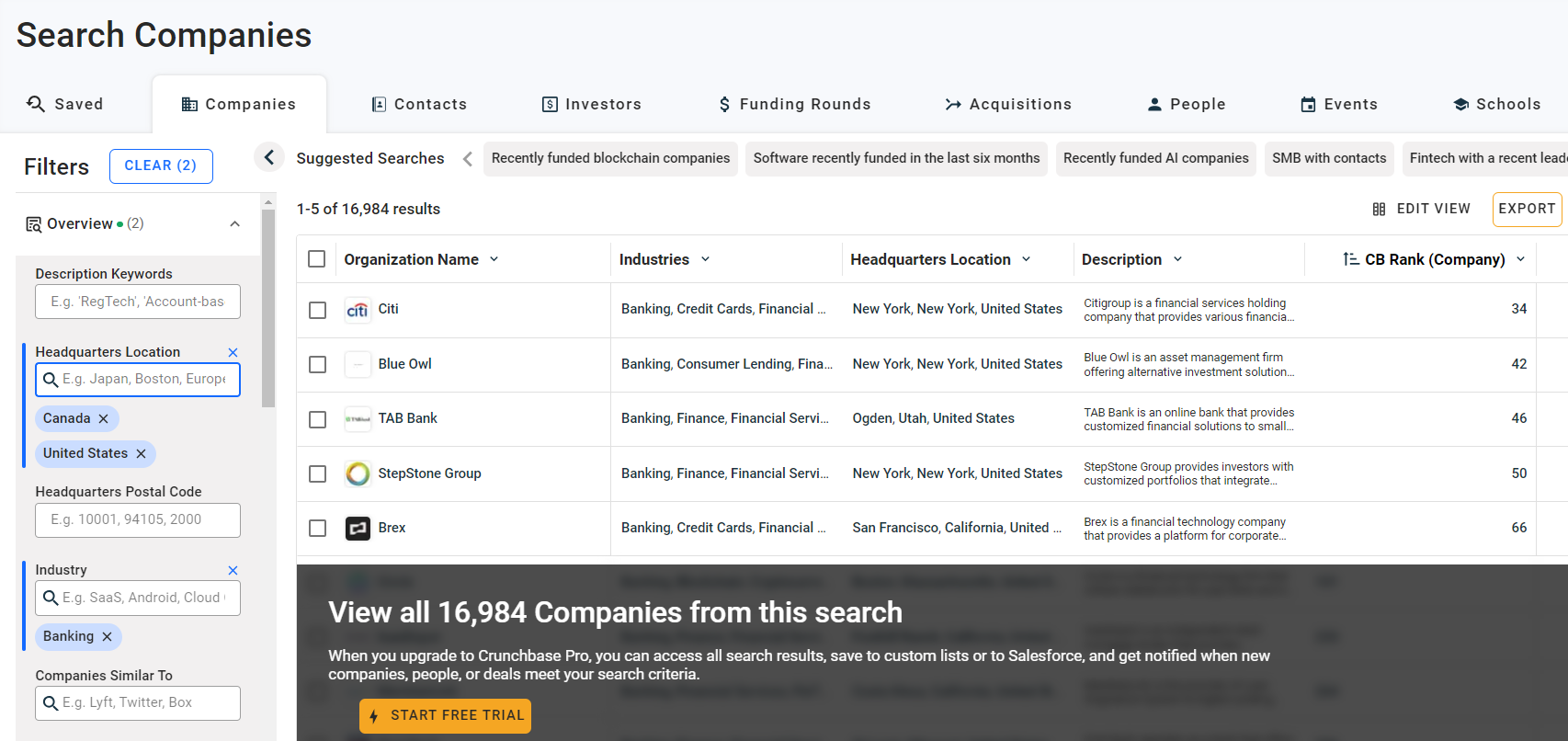

Crunchbase

💲Free / Paid for advanced features (7-Day Free Trial available)

Even in the free version, Crunchbase provides filtering options by size, industry, location, funding, growth signals, and more. For a more nuanced search, you can use their Query Builder. To access third-party data like tech stack or IT budget, you can upgrade to Data Boost (a paid feature that adds 55+ filters; a free 7-day trial is available).

LinkedIn Sales Navigator

💲Paid / 30-day Free Trial available

This is a powerful tool for researching companies. You can filter based on headcount, industry vertical, location, technology used, department headcount, and more. It's an advanced (and paid) tool, so unless you plan on using it further for sales enablement, it may be an overkill.

Here’s a Sales Navigator 101 guide by LinkedIn.

Research customer needs, pain points, and willingness to pay.

Whether you have an existing product or plan on developing a new one, you likely have assumptions about your customers' needs and preferences.

However, assumptions only go so far. The goal is to validate those assumptions by aligning them with real-world customer pain points and unmet needs.

Additionally, look at typical budgets to estimate how much target companies are likely to spend on your type of solution.

If you notice that the budgets are consistently minimal, consider it a warning sign. There’s a significant risk that your financial returns could be limited unless your innovation is so groundbreaking that customers will be willing to adjust their budgets and line up begging "Just take our money!"

Gather customer preferences via direct customer surveys or interviews.

Use SurveyMonkey, Google Forms, or any other survey platform to create and distribute surveys. Ask questions about challenges, unmet needs, desired outcomes, and willingness to pay. Alternatively, conduct one-on-one interviews via Zoom with key decision-makers from target companies.

This, however, is easier said than done.

In a B2B setting, it’s much harder to find the right audience compared to B2C.

The best (and easiest) approach is to leverage your existing customer base.

If you don’t have customers yet, LinkedIn is the next best alternative to find employees of your target companies. Start building relationships with them so that they are willing to answer your questions.

Another method is to attend conferences or meetups where representatives from your target companies participate.

Finally, an option is to engage in online communities where your target audience is active. If you’re an active contributor and your product/idea is perceived as helpful, your audience may be more willing to fill out your surveys and agree to interviews.

It’s important to note, though, that building relationships on LinkedIn or online communities is often a long-term strategy. You may not (and probably won’t) get immediate responses to your surveys or interview requests. Offering an incentive, say a discount or free access to a valuable report or guide, can potentially encourage people to take time out of their schedules to participate in your research. But don’t overdo it or get too cheesy.

Gather and analyze data already available on the Internet.

Yes, direct customer interviews or surveys (especially when done right) are generally regarded as one of the most reliable ways to gather customer insights. However, if you’re in a situation where that’s not feasible, the Internet offers a wealth of data you can leverage.

As you conduct your research, keep an eye out for recurring themes. If you notice multiple people discussing the same challenges, it’s likely an indication of widespread pain points.

⚙️ RESOURCES

Internal Data

💲Free

If you have existing customers, analyze your historical sales data to identify recurring customer needs and spending patterns. You can use these findings to benchmark potential spending in the broader market.

Additionally, support tickets can provide painful valuable insights into common challenges and unmet needs.

Customer Surveys

💲Free/ Paid (depends on the survey tool you use)

Conducting customer surveys is a direct way to ask your target audience what challenges they face, how much they’re currently spending or willing to spend on solutions in your category.

Here are some of the survey tools for you to consider:

Google Forms

Good-old survey tool: free, quick to set up, and easy to use. While it lacks advanced features and customizations, it remains a solid choice for quick initial surveys.

Typeform

Typeform is known for probably the most visually appealing surveys, which can potentially lead to higher completion rates. What is also good about them is their market research templates.

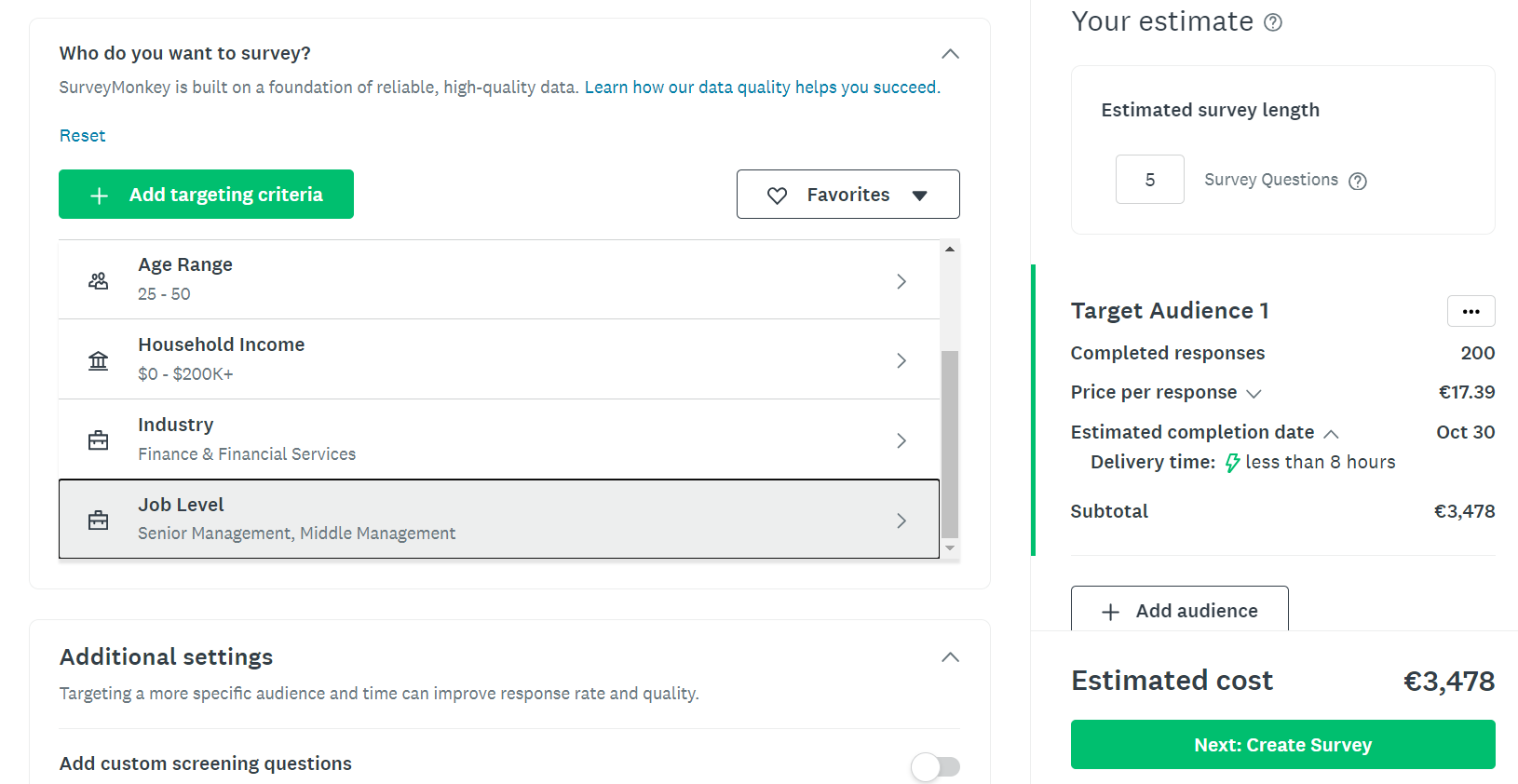

SurveyMonkey

SurveyMonkey is one of the go-to tools for creating surveys, offering pre-built templates, reporting features, and an overall user-friendly experience.

But I bet you know that.

What you may not know, though, is that SurveyMonkey offers a service called SurveyMonkey Audience.

It provides access to a large, targeted pool of respondents (over 335 million people across 130+ countries) allowing you to gather survey data quickly. This service is great for market validation and exploratory research in tech B2B.

However, while using SurveyMonkey Audience sounds promising, it can get quite pricey.

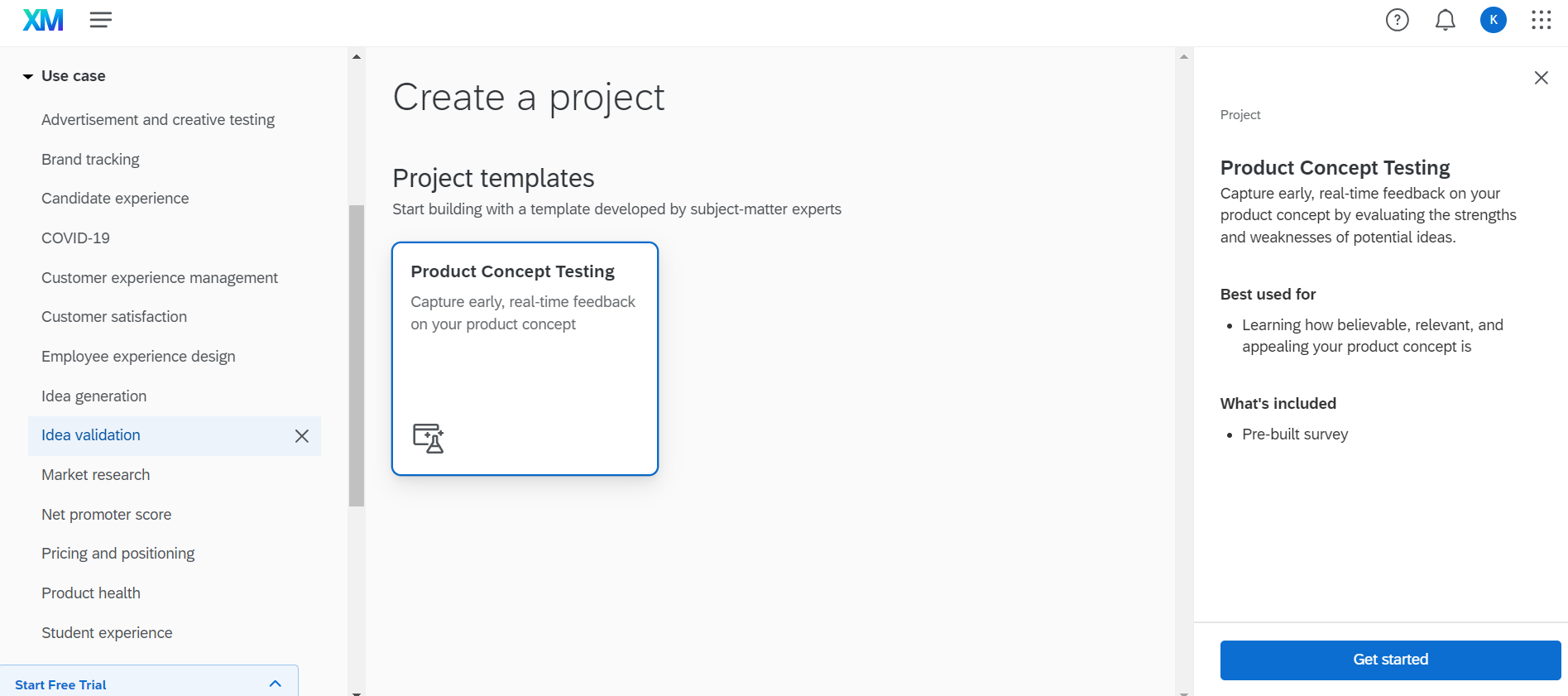

Qualtrics

As enterprise-grade as a survey tool can get — robust, advanced, with online panels, and definitely on the pricier side. Qualtric offers a full suite of features, along with professional services to guide you from point A to point Z of your customer research journey.

If you're on budget, Qualtrics offers a free survey maker tool with 50+ pre-built templates.

Personally, I’ve learned a ton from Qualtrics blog and courses. You may consider checking their Implementing Research Methodology learning path to gain a deeper understanding of how to make your research projects methodologically sound.

Competitor Websites

💲Free

Competitor websites, as counter-intuitive as it might sound, can actually be a goldmine for insights into customer needs, challenges, and even budgeting.

Check out their pricing pages to get a rough idea of what similar customers are likely paying for comparable solutions.

Also, take a look at case studies (if available), as they often reveal the exact pain points that customers in your market are dealing with.

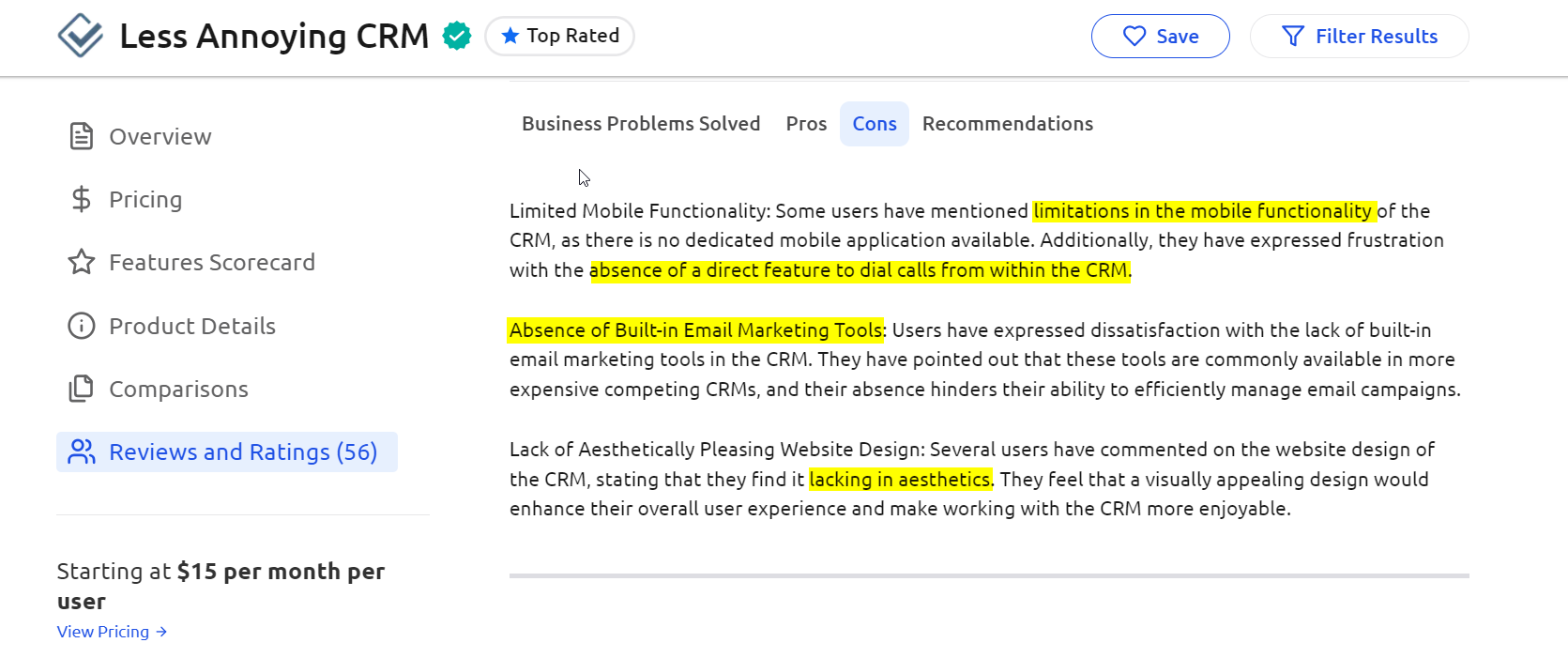

Review Sites

💲Free

Review sites host reviews from actual users and are among the best sources of insights into common pain points, desired features, and overall customer satisfaction.

- G2

3.2M monthly visitors[1] - AlternativeTo

5.5M monthly visitors - Capterra

2.7M monthly visitors - Gartner Peer Insights

3M monthly visitors[2] - GetApp

1M monthly visitors - Software Advice

750K monthly visitors - TrustRadius

650K monthly visitors

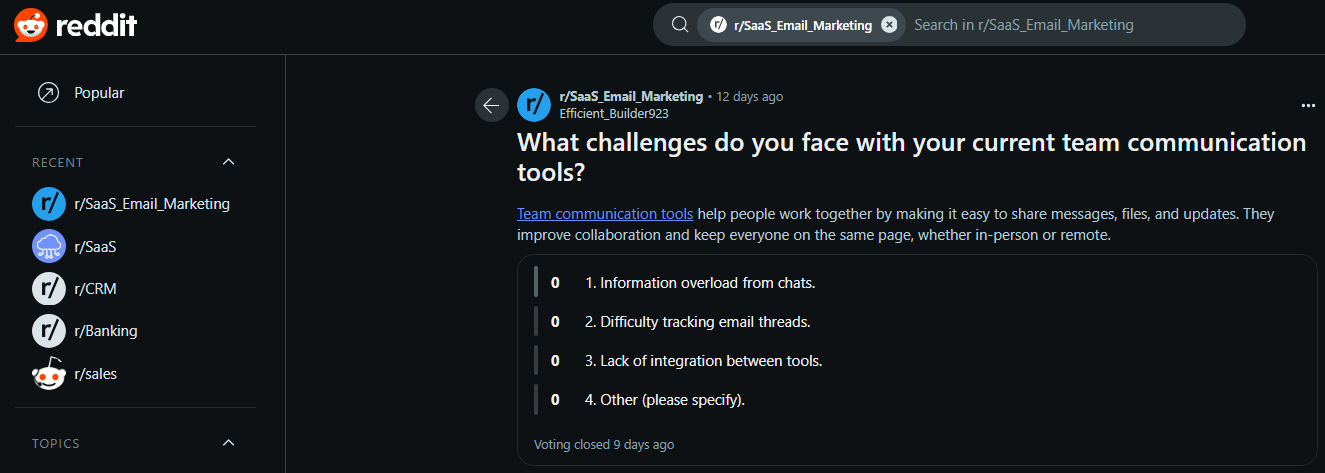

💲Free

Reddit’s niche communities (subreddits) like r/CRM, r/SaaS_Email_Marketing, and others offer candid discussions on tools and services. You can engage in these communities to gather direct feedback or observe real user experiences. While searching on Reddit can feel a bit messy, it’s worth a look given its estimated 1.2 billion monthly unique visitors.

Here’s a short guide on how to use Reddit’s search effectively.

Summarize your findings.

Now, what can you actually do with this info?

After completing the steps of identifying your target customers and researching their needs, pain points, and willingness to pay, you need to transform your insights into concrete actions you can take.

Here are some ideas for you to consider:

- Group your customers into segments based on what you’ve learned — industry, company size, specific pain points, etc. This will help you get targeted in your approach instead of going with a one-size-fits-all strategy.

- From your research, pick out the most common and painful challenges. These are the areas you’ll want to focus on solving, as they’re likely what will resonate most with your audience.

- For each customer segment, define a clear value proposition that speaks directly to their top challenges. Show them exactly why your solution is the best fit for their needs and why they shouldn’t look elsewhere.

- Based on the budget data you gathered, set your pricing strategy. Think tiered options or value-based pricing. Remember, you want pricing that feels justified to them, so they see it as worth the investment.

- If you identified unmet needs or gaps that aren’t being addressed, think about how you can incorporate these into your product roadmap. This could give you a unique edge over competitors.

Competitors.

What do they offer, and how does this impact you?

How cometitive is your market overall?

The supply side of your market typically includes:

- You (if you're already a part of it),

- Your competitors,

- Key ecosystem partners such as system integrators (SIs), value-added resellers (VARs), and other entities that integrate, enhance, or resell your products and solutions as well as those of your competitors.

Get to know your competitors.

Determine who your competitors are.

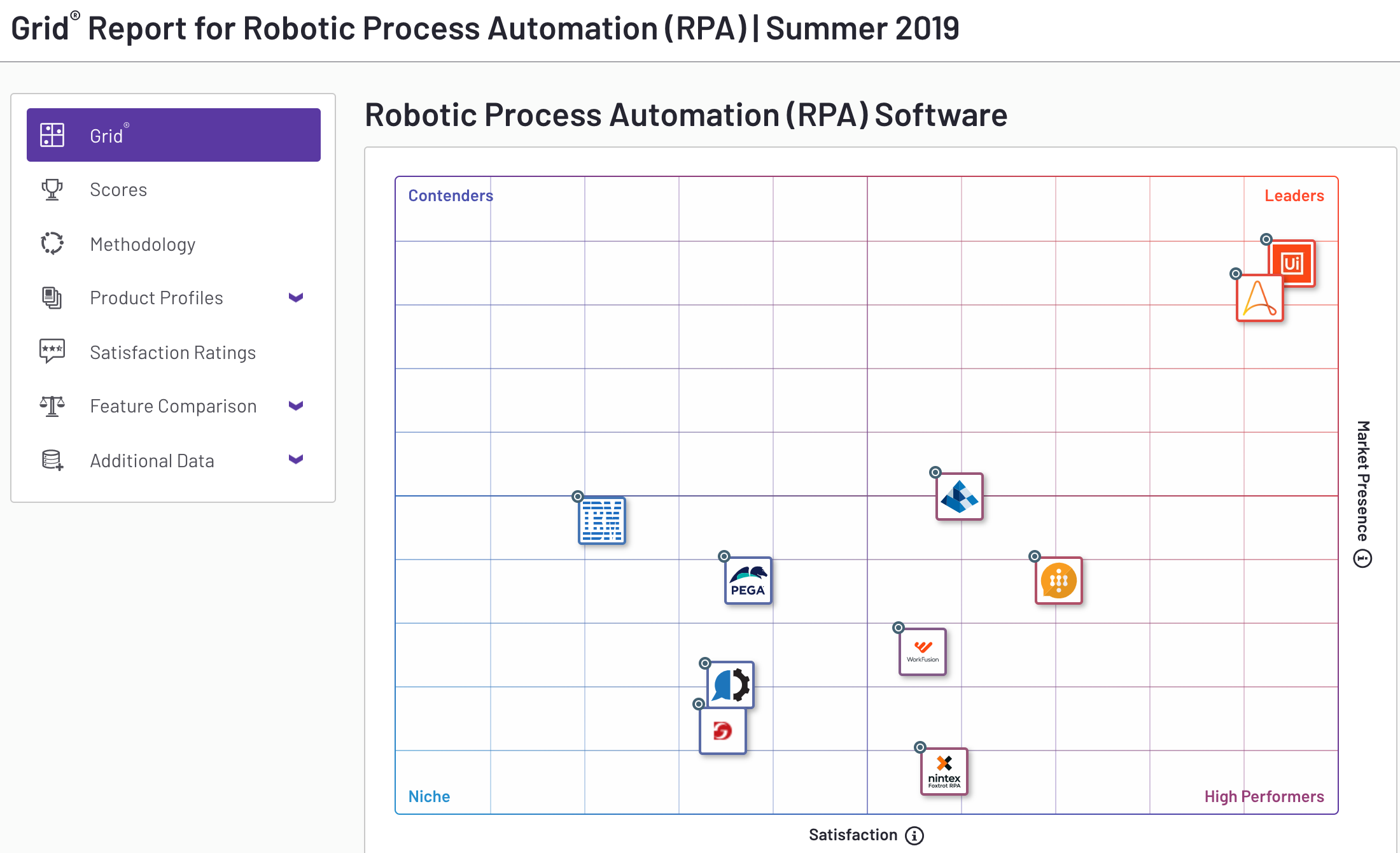

Use analyst reports or review sites to identify active vendors on your market. Evaluate their overall market standing — are they leaders or laggards, mainstream or niche players?

Analyze what your competitors offer (and how).

Compare features, pricing, and the value proposition they communicate to customers. You’ll want to determine how they position their products. Do they focus focus on innovation, cost-effectiveness, being cutting-edge next-best-thing or something else?

Compare their offerings with yours.

Perform a side-by-side comparison of your product and competitive offerings. Focus on positioning, key differentiators, pricing strategies, and customer feedback.

⚙️ RESOURCES

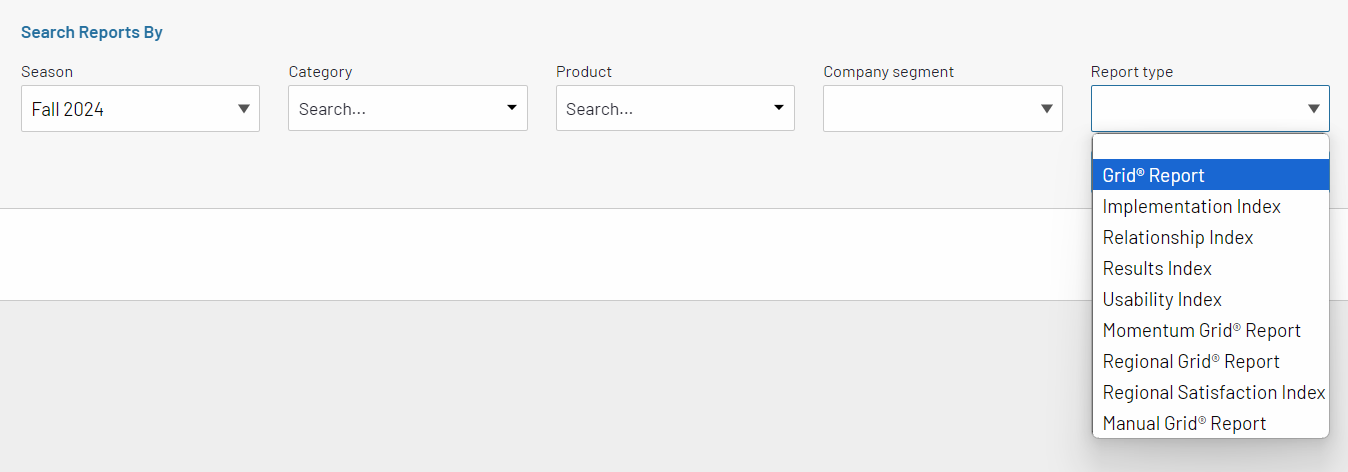

G2 Market Reports

💲Free (registration is required)

G2 market reports are a valuable (and still free) source of competitive information. Start with their high-level Grid Reports to gain a general overview of the vendors in your market. Then, use the Index Reports for deeper insights into specific factors like usability or achieved results. The Momentum Grid Reports will help you identify which products are currently trending.

If you have an extra budget, you may also consider G2 Market Intelligence for "unmatched, in-depth data when you need it," as G2 claims. But as one of the reviews says, "The biggest downside to this is its pricing... Only established product based companies can afford such a huge pricing and get ROI out of it."

Capterra Shortlists

💲Free

Maybe not as detailed as G2 Grids but still a quite useful tool for identifying and evaluating your competition. And no registration is required, so it’s a nice bonus. Here’s the link to the Capterra Shortlist Methodology so that you have a better feeling of how they choose and position vendors.

Crunchbase

💲Free / Paid for advanced features (7-Day Free Trial available)

Crunchbase is particularly helpful for identifying newer competitors and monitoring their growth and funding activities. You can filter competitors by size, location, funding, growth signals, and more. For a more nuanced search you can use their Query Builder or upgrade to a Pro account.

Industry analyst reports – Gartner, Forrester, IDC, Frost & Sullivan

💲 Paid / Free previews may be available

Reputable analyst reports offer in-depth analyses of key competitors and the overall market landscape, including how vendors are ranked based on their market presence, product capabilities, or growth potential.

But! they are hella quite expensive. The workaround is to carefully analyze previews since they can be very informative, or look for these reports (or their parts) reprinted by vendors mentioned in them. Such reprinting is quite common with Gartner Magic Quadrants.

Competitor websites

💲 Free

Analyzing competitor websites is a straightforward way to assess what they offer and how they position their products. Look at pricing, product pages, case studies, and customer testimonials to understand their core offerings and messaging.

If they’re overusing terms like industry-leading cutting-edge top-notch best-of-breed AI-driven cloud-native something check whether it's just marketing buzz or if there’s a substantial basis for these claims. The easiest way to do this is by researching their developer portals (if available) or analyzing customer reviews.

Industry events

💲 Free / Paid

If you attend industry conferences or trade shows, visit competitor booths and attend their speeches or panels. This can provide direct insight into their messaging. Pay attention to how they highlight their product’s unique value, the pain points they address, and their differentiation.

Many events also feature live demos, revealing product features, new developments, and typical use cases.

Booth size can also be telling. Companies with larger booths (or prime speaking slots) often have bigger marketing budgets, which may indicate market strength, sometimes more clearly than any analyst report.

Webinars

💲 Free / Paid

Webinars typically reflect strategies, common challenges, and trends. By attending them, you can gauge what they emphasize and see how their focus aligns with or differs from your own. Many events release post-session recordings, blog recaps, or slides. Reviewing these materials can also be helpful.

Public financial statements / Investor presentations

💲 Free

Often overlooked but golden source of strategic info on publicly listed competitors. Search for their SEC filings and investor call presentations. Typically, there you’ll find all sorts of data – strategic priorities, revenue across products, key customers, and much more.

Summarize your findings.

Now it’s time to make that competitive research work for you.

Knowing who your competitors are and what they offer is great, but turning those insights into a competitive advantage is even better.

Here’s what you can do:

-

Map out the competitive landscape to clearly see who you compete with.

-

Identify unique selling points (USPs). Highlight areas where your product or service stands out. Maybe it’s a specific feature, pricing advantage, customer service quality, whatever it can be. These USPs should become a cornerstone of your messaging and positioning.

-

Identify where your competitors fall short. Are customers frustrated with certain features, support quality, hidden costs? These weak spots are your opportunity to differentiate and address unmet needs.

-

Adjust your value proposition to target areas where competitors under-deliver or where you have a distinct advantage. Be specific about what you offer that others don’t.

-

Use your competitor research to fine-tune your pricing and features. If your main competitors are priced higher but lack certain features, consider emphasizing that added value. If they’re undercutting you on price, make sure your premium benefits are clearly communicated.

Ecosystem Partners.

How can you leverage relationships with them?

Analyze key partners and their contribution to market dynamics.

The supply side isn’t just about competitors.

It also includes system integrators (SIs), value-added resellers (VARs), channel partners, and such. These partners can play a huge role in helping customers select and adopt solutions.

For instance, SIs often provide specialized technical expertise and integration services, ensuring that complex solutions fit seamlessly into a customer’s existing infrastructure. VARs may add tailored features or services to products, enhancing value for niche markets, while channel partners broaden market reach, providing localized support and access to new customer segments.

The first step is to identify the key ecosystem players in your market.

Then evaluate how competitors leverage these partnerships and consider the potential benefits of collaborating with these ecosystem players.

Use this analysis to identify valuable partners for relationship building.

⚙️ RESOURCES

Competitor websites

💲 Free

Visit your competitors websites, looking for Partners or Ecosystem pages where they often list their key collaborators, including SIs, VARs, and channel partners. Additionally, explore relevant marketplaces and partner directories (like AWS Marketplace or Salesforce AppExchange) to find companies offering complementary services or add-ons.

Also, search for recent press releases, announcements, and news articles related to partnerships.

Industry analysts

💲 Paid (Free previews may be available)

Analyst reports, such as those from Gartner, Forrester, or IDC, often contain sections on ecosystem players and typical partnerships within your industry. However, as mentioned earlier, these reports are expensive, so I wouldn’t recommend making them a priority unless you’re an established vendor with a substantial budget.

Industry events and webinars

💲 Free / Paid

Industry conferences, trade shows, and webinars are places where ecosystem partnerships are often featured. Companies might present alongside SIs or VARs, demonstrating collaborative solutions and joint strategy.

Summarize your findings.

After analyzing the ecosystem landscape, summarize the key insights and actionable takeaways to guide your partnership strategy.

Focus on the following areas:

-

List the primary types of partners (SIs, VARs, channel partners, etc.) that play an essential role in your market. Highlight any specific companies or organizations that stand out as influential or active within this ecosystem.

-

Summarize how competitors are leveraging these ecosystem partners. Note any patterns, such as competitors collaborating with particular types of SIs for technical expertise or VARs to enhance niche product offerings. This will give you an idea of standard practices and innovative approaches within your industry.

-

Outline the potential advantages of forming partnerships with these ecosystem players. For instance, certain SIs might help strengthen your product’s integration capabilities, while channel partners could expand your market reach and customer support capacity.

-

Identify the ecosystem partners you see as valuable for your strategy. Based on your findings, list partners that align well with your goals, whether they’re major industry players or niche specialists that could help you differentiate.

-

If any opportunities seem underutilized by competitors (e.g. partnerships with VARs in certain regions), highlight these gaps. This can help you identify unique opportunities to stand out or fill unmet needs in the market.

External Influencers.

It's important to grasp both the demand and supply sides of your market, but you must also consider external factors that influence market dynamics.

Regulators, industry research organizations, and investors can greatly influence how businesses operate and grow. These groups shape the larger environment in which your company competes, so analyzing their impact is crucial for making informed strategic decisions.

Analyze key regulations and their market impact.

Regulations are essential in shaping the business environment, particularly in industries like telecom, healthcare, and finance, where compliance requirements can be strict.

Thus, it's crucial to understand the key regulations that impact your market to avoid legal issues and establish your company as a trusted, compliant vendor.

The first logical step is to identify the local, national, and global regulations that apply to your industry. Once you've identified the relevant regulations, the next step is to assess how these rules impact your industry. Another important step would be to analyze which of your competitors comply (or do not comply) with those regulations.

Here are some common regulations to keep in mind.

Data privacy and protection regulations:

- GDPR (General Data Protection Regulation) – applies to companies operating in or targeting the EU and governs data collection, storage, and processing of personal information.

- CCPA (California Consumer Privacy Act) – applies to companies that process California residents' data, focusing on data transparency, control, and deletion rights.

- CPRA (California Privacy Rights Act) – an amendment to CCPA, effective in 2023, adding more stringent requirements around data handling and introducing a new enforcement agency.

- PIPEDA (Personal Information Protection and Electronic Documents Act) – Canada’s privacy law, governing how organizations collect, use, and disclose personal information.

Industry-specific compliance (if applicable):

- HIPAA (Health Insurance Portability and Accountability Act) – applies if the company handles Protected Health Information (PHI) of U.S. residents, especially relevant for tech companies offering healthcare solutions or services.

- PCI-DSS (Payment Card Industry Data Security Standard) – required for companies processing, storing, or transmitting credit card information, including B2B companies handling payments.

Cybersecurity standards and regulations:

- NIST Cybersecurity Framework – guidelines for improving cybersecurity practices, often used by B2B tech companies as a security benchmark.

- ISO/IEC 27001 – an international standard for information security management, widely recognized across industries and relevant in tech B2B.

- SOC 2 (Service Organization Control 2) – essential for companies offering SaaS solutions; it outlines security, availability, confidentiality, and privacy controls.

Understand how industry analysts shape your market.

Industry analysts, like them or not, have significant influence over how your company is perceived by customers and potential partners. Their evaluations can either amplify or limit your visibility, depending on how you’re ranked (or whether you're mentioned at all).

Start by identifying the key analysts covering your market, which likely includes firms like Gartner, Forrester, IDC, and Frost & Sullivan (and yes, that’s why I’ve referenced them multiple times in this post).

Their evaluations and reports, like Gartner’s Magic Quadrant or Forrester’s Wave, carry considerable weight in enterprise purchasing decisions.

It’s also worth paying attention to any strategic recommendations these analysts make, as they often drive industry-wide trends that can affect your market positioning and future strategy.

Identify top investors and understand their priorities.

Investors play a pivotal role in shaping the trajectory of many tech companies.

Understanding which investors are backing your competitors, and what their priorities are, can provide valuable insights into the market’s future.

Start by identifying the major investors actively funding companies in your industry. These could include VC firms, angel investors, or private equity players. The investors behind your competitors can reveal market confidence and signal where future growth is likely to occur.

For this research, tools like Crunchbase's Search or Find Investors can be helpful.

If you identify investors who are particularly active in your market, it’s worth digging deeper. Key areas to investigate include:

- What kind of growth trajectory are investors seeking in companies they fund?

- Are they favoring certain types of technology or business models?

- Do they have preferred exit strategies, such as acquisitions or IPOs?

Understanding your market structure is essential for any B2B company aiming to compete effectively (and that’s probably why you stuck around till the end!).

By breaking down the demand side (who your customers are and what they want), the supply side (who your competitors are and what they offer), and the external influencers (such as regulations and industry analysts), you’ll gain a clearer view of where you stand and where untapped opportunities might be waiting.

The only thing left is to put this knowledge to work. 😊

In the next part of this series, we’ll dive into Market Evolution — how your market has developed over time, why it matters, and how understanding these shifts can help you stay ahead of the curve.

Stay tuned as we continue building out this framework, one step at a time, so you can confidently navigate the B2B tech landscape and keep your competitive edge.

Disclaimers:

This blog is all about sharing insights and ideas. While I do my best to provide accurate information, I’m not offering legal or financial advice. If you need expert guidance, please reach out to a qualified professional.

I am not affiliated with any of the tools mentioned in this post, and none of the links are referral links. My recommendations are based solely on their relevance, usefulness, and my personal experience using them.